What Savvy Credit Managers and Analysts Must Do to Mitigate Risk on Credit Sales in Mexico

Summary: International credit sales add significant risk to exporters. Credit managers of exporting companies selling to the Mexican market must understand such risks and put a strategic plan in place to mitigate them. This article discusses the strategy and plan to support credit sales to Mexican customers in a safe way for business success.

Trade Credit in Mexico: To Sell or Not to Sell?

As a debt collection lawyer in Mexico, I have seen cases where creditors have failed to collect on an outstanding debt. Sadly, most of these cases involved situations where the seller offering trade credit in Mexico ignored the potential risks involved. He did not have a plan in place to engage in international business successfully, based on sound strategy. These sellers were selling with their eyes closed, based solely on a complete trust of their customers and word from their sales representatives. They never considered objective facts, and never questioned how they would enforce their claims, if things went bad. These cases were doomed from the start, due to poor planning, poor controls, and costly mistakes.

As competition grows, new markets in other countries become an option impossible to overlook. The challenge is not only selling to those markets, but selling on open account terms, as most competitors will be willing to do. Fear of selling to those markets is somehow justified because of the main risk involved: the risk of not getting paid. Mexico is no exception and does present challenges. Should you be worried to the extent of holding out and giving up that piece of the pie to competitors? Is trade credit in Mexico not an option? Should you worry about selling and not getting paid?

Unmistakably, you shouldn’t worry about selling into Mexico. What you should worry about is selling with your eyes closed, without a proven plan. The fact is that it is possible to sell to Mexico on open account terms successfully. For this you will only need a proven plan to minimize risks and secure trade credit effectively. The following article will discuss the strategy and will provide a detailed plan for doing so.

The Strategy and Game Plan for Exporters

Sun Tzu once said: “Position yourself where you cannot lose” (The Art of War 4:3.22). To gain this position, strategy is key. My proposed strategy is based on those collection cases that went bad. By looking at the things credit managers did wrong, we can correct situations and put a game plan in place. We will do some reverse engineering. We will focus on the things that could have helped creditors improve their position during their collection cases. This way, we will position ourselves where we cannot lose. But before we can develop a strategy, we begin with the diagnostics.

Problem cases

In many cases creditors could not collect their money because they engaged in business with a dishonest business owner who was out to get them. Other debtors had a plan to get out “untouched”. We saw other cases where creditors dealt with unproven business owners. They represented companies that were financially unstable, economically unviable, had a multitude of lawsuits, or were simply broke. The remaining cases where those where the creditor simply didn’t have good evidence, a written contract, or guarantees. This prevented them from bringing a strong lawsuit to get a judgment and force the debtor to pay.

Strategy and game plan

From the highlighted cases, we can design and create a game plan. First, we must screen out potentially bad or high-risk customers. Second, we must put in place key documents and contracts that will allow the creditor to enforce its claims through the Mexican courts effectively and efficiently. In other words, we must create a strategic advantage for the creditor in court, should litigation be required to collect its debt. This game plan results in creating a new credit & sales policy for Mexico and using it every time before extending trade credit. The policy must include the following:

- Do a proper due diligence work for credit analysis.

- Use the credit application and sales documents effectively.

- Add security, including collateral, guarantees, and options for legal action.

1. Doing proper due diligence for credit analysis before sales

When a potential customer is at your door asking for trade credit in Mexico, you must make sure that this prospect will be a likely payer. Requesting financial information from the customer is just the beginning. You need to go beyond that by doing your own due diligence work, or your own investigations. Through your own sources, you want to confirm the information that the customer is presenting, or find high-risk situations not revealed.

The five “C’s”, for credit sales in Mexico

Savvy credit managers know that there are at least five factors that need to be evaluated from your prospect customer before extending trade credit not just in Mexico but everywhere:

- Character. This refers to the willingness of a debtor to pay its obligations. Does the customer show notions of integrity, honesty, and moral responsibility? Do you trust the owner personally? Will he keep his word?

- Capital. This refers to the financial strength of the company, the value of their business in terms of equity and net worth. It is not necessarily cash. Do they have assets that we can go after if they don’t pay? These could be buildings, machinery, equipment, inventory, finished products, etc.

- Capacity. It is the customer’s ability to generate positive cash flow. It’s the ability to operate profitably and to timely pay all creditors, employees, suppliers, etc. This also has to do with the competency of the customer at business.

- Collateral. This refers to property that can be “pledged” or offered as security to guarantee payment of the debt. It includes equipment, buildings (real estate), accounts receivables, inventory, etc. Not only will you ask if these assets exist, but whether the customer is willing to offer them as collateral.

- Conditions. This refers to external events or phenomena that may disrupt the normal flow of business. It includes government regulations and restrictions (such recent Covid-19 measures and lockdowns), national or regional economic environment, fluctuation in currency exchange rates, competition, etc.

Basic online investigations

There are many ways that you can obtain information that reveals the reality of these factors, including “red flags” or “high-risk” present in some customers. While international credit reports are offered by a handful of companies, there are plenty of reliable online databases from the Mexican government where you can conduct investigations on your own.

The following is a list of some of these public databases. In most of these you will need a tax ID from a Mexican national to open an account and access the database. if you don’t have a representative in Mexico who can assist with this, it is wise to call your Mexican lawyer or accountant for help.

- SIGER. This is where you find corporate information on most companies incorporated in Mexico. You can confirm designation and authority of managers and legal representatives, identity of shareholders, capital stock of company, shares subscribed by each shareholder, etc. The system is user-friendly and allows different search criteria, which allows for you to find other companies related to your customer such as parent, subsidiaries, sister companies, etc. If you cannot get access to SIGER our firm provides a free report to help you start your due diligence work.

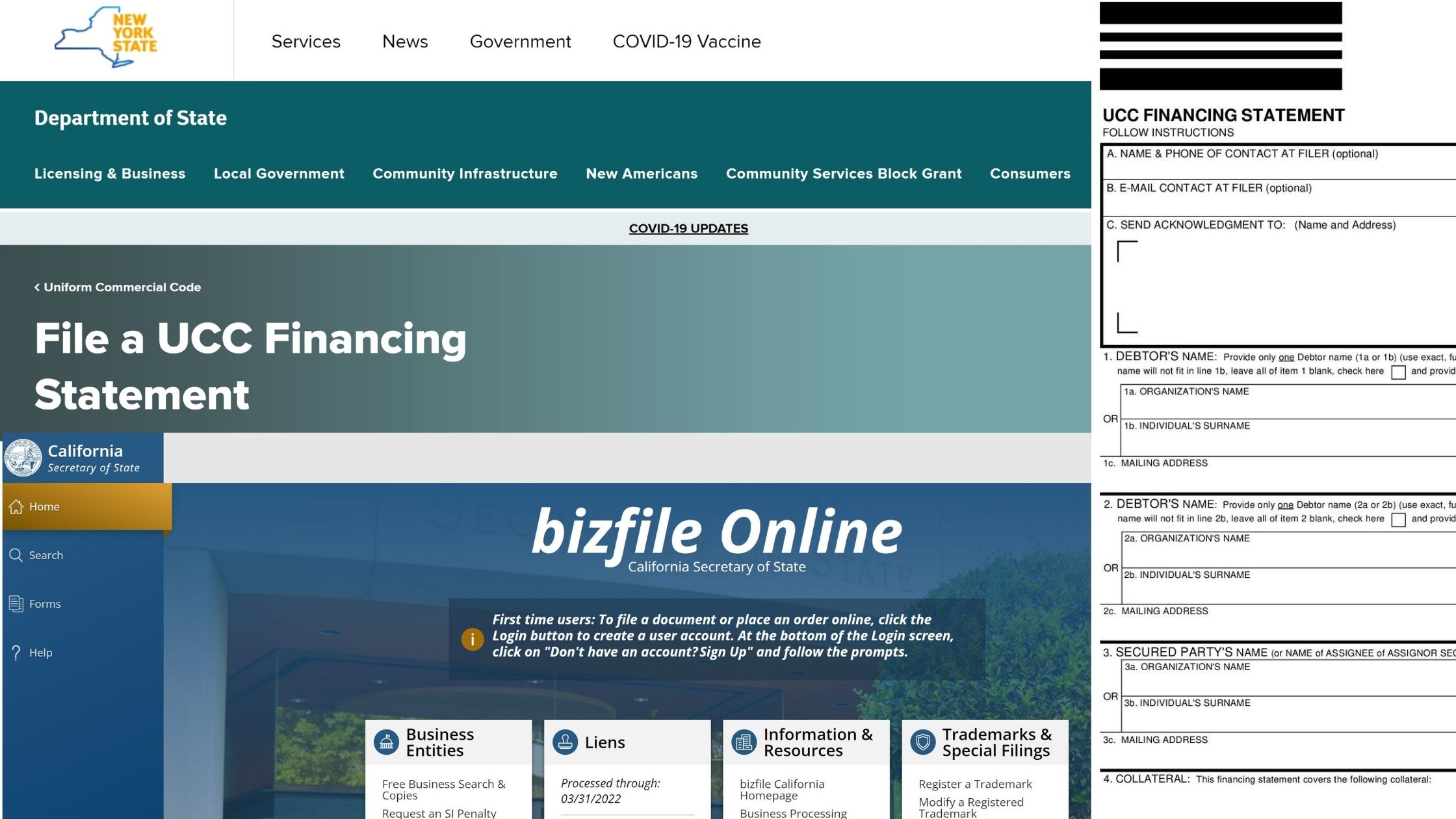

- RUG. Here you find security interests, liens, and loans filed against or related to your customer in Mexico. Since this registry is free and online, more creditors are using it more often in their transactions. Thus, it is robust and has plenty of reliable information.

- MARCIA. This online system was developed by the Mexican Institute of Industrial Property (“IMPI”). It runs with artificial intelligence technology, which allows to search by trademark name and images. You can also search by name of registered owners of trademarks through their traditional search system. A customer with enough history and strong brand presence is a bit more trustworthy than a company that just opened shop.

- COMPRANET. This system compiles all public contracts executed with the federal government through procurement. You can download Excel files with all contracts for each year. It is key information when you are dealing or partnering with a customer that intends to sell to the federal government. Here you can confirm their good standing as a government supplier or find out about current or past contracts.

- Mexican Credit Bureau. The Bureau offers reliable reports regarding the credit history of companies and individuals in Mexico, key for trade credit decisions. They problem is that these reports are not for sale to the public. To buy and obtain these reports you must enter into a contract with the Bureau and become a credit information supplier. Since the Bureau offers at least one free credit report per year to everyone, it is wise to ask your customer to get a report himself and provide it to you for evaluation. It is an easy and fast process.

- INEGI. Website for Mexico’s National System of Statistical and Geographical Information. Here you will find information on Mexico regarding the territory, resources, population, and economy. If you are to review the conditions for your customer, it makes sense to see the current & past state of his industry.

Advanced investigations and tasks

While these online databases provide useful information right away, there are other key investigations that should not be overlooked. These have a cost, but they are a valuable step worth taking before offering credit on sales in Mexico.

- Lawsuits Report. Many service-providers in Mexico offer these. An investigation is made throughout the country, showing any lawsuits where your customer is involved, both at State and federal courts. While the information is limited, it will show if your customer is involved as a plaintiff or a defendant, the type of case, and the places where they take place. A customer with many lawsuits as a defendant in an executory type of proceeding is a big red flag.

- Local Public Registry. If SIGER does not show information on your customer, you need to consult the local public registry. In addition to corporate information on companies, here you will find other items that belong to your customer, including hard assets (real estate), loans, liens, bankruptcy proceedings, liquidation process, etc. The problem with the registries is that the turnaround time is unpredictable, and costs are generally high. It is key to have a reliable local source who knows the system and can assist with these investigations efficiently.

- Physical Inspection. Are you sure that your customer’s office, warehouse, or facility is not an old shack? Many times, when collecting claims in the thousands of dollars, we have come across facilities that are nothing like the huge empires that these debtors once claimed to be. Creditors simply ignored this part and never visited the customer. You need to send someone to verify. If this is complicated, you should at least walk around the customer’s neighborhood in Google maps and check out your customer’s address.

Remember that not even the strongest contract will save you if you run into a company with a history of fraud, a history of lawsuits, or one that is heavily undercapitalized. Thus, investigate your prospect well to assess all five “C’s” thoroughly. Invest the time, money, and effort that each line of credit demands.

Once you have screen-out potentially bad customers and are ready to do business, it’s time to use documents to support sales properly, starting with your credit application.

2. Using the credit application and sales documents effectively

The credit application should have a two-fold purpose. Primarily, the credit application should include essential information for credit analysis and decision. This is usual practice. Secondly, the credit application is the perfect opportunity to create an enforceable contract with your customer. This since he will sign such document in making his credit request.

Sales documents are equally important as they will help you bring a strong action in court. These will help prove your claim that you performed your part of the contract and, thus, the debtor must pay. In this section we will discuss the kind of documents that are needed, as well as the ideal credit application.

The application for credit analysis

Credit applications serve a main purpose of obtaining essential information about the prospect customer. They will usually contain the same general items, such as:

- general information about the prospect buyer,

- financial and business information,

- business & banking references, etc.

I personally like to include items or questions that can easily be verified through investigations, which could highlight a red flag, or that can further assist with legal action. These are some examples:

- Does prospect currently have lawsuits?

- How many corporations at same address?

- Is prospect part of a corporate group?

- Name of customs broker in Mexico

- Years in business and brand presence

There are reasons for these questions. First, I want to make sure my customer is truthful. These questions can be easily verified through investigations. Second, corporate groups and several companies or businesses at one address location is high-risk. This is because piercing the corporate veil [communicating liability to shareholders of a company for their abusive control, which results in fraud] is extremely difficult in Mexico. Third, a customs’ broker can be summoned to court to testify. He can confirm if our debtor purchased and imported our products. This becomes easier if we know his name. Finally, I would be more comfortable knowing that my customer is well-established in the market, rather than a risky newcomer.

There are just some examples. You should be creative to come up with key information that you need to know, or that you want your customer to answer for a better assessment of the five “C’s”. Again, it’s all about mitigating risk on credit sales to Mexico.

The application as your main contract

After you finish determining the key content for proper credit analysis, it’s time to work on your sales contract. Remember, if you don’t put the rules on your customers, they will put the rules on you!

The credit application is the perfect opportunity to create an enforceable sales contract. You do that by adding a page that includes those key terms and conditions of sale that will provide a strategic advantage in court. You must position yourself where you cannot lose.

Problems with domestic terms of sale

Your current domestic terms of sale will probably not work. This is because you’re venturing into another country, with a different culture and legal system. Some of the remedies under the current terms may not be recognized or adequate under Mexican law, which merits adjusting your contract accordingly. Thus, you must discuss with Mexican counsel to identify the best terms of sale.

Your terms of sale will depend on a lot of factors such as industry, nature of product or service, competitors in the area, etc. Regardless, they should always strive to give you a strategic advantage in court. They should also create the right “incentives” for your customer. The debtor should know that it is better to pay timely and voluntarily, rather than face an expensive lawsuit.

Key terms of sale

You should always consider or assess the following clauses in your terms of sale:

- Jurisdiction and venue. Which is the best court to hear your case, and to compel your debtor to pay? Is it the one in your country, in your town? Are you sure you will be able to enforce your judgment in Mexico? Enforcing foreign judgments in Mexico is complex, hard, and risky. Thus, think hard and think again. You must find and select the best courts for your potential case, or the most adequate. If those are the ones in Mexico, what is the best place? Courts in one State will outperform the courts of the neighbor State. Some courts will be inconvenient to the debtor, while others friendly. Some courts will show less corruption, or almost none. Strategy is key here, and this is where a discussion with Mexican counsel pays dividends.

- Governing law. This is where your current terms of sale not just don’t help but hurt. Many applications include governing law clauses that point to the place (country) of the seller. The sellers should expect tough challenges. If you need to collect your claim through a Mexican court, you should choose governing law accordingly.

- Choice for arbitration. Arbitration should always be an option. Unlike court judgments, enforcement of arbitral awards are neatly provided under Mexican law and, thus, are more predictable. An option for arbitration is key. Just be careful with optional clauses that give the option exclusively to one party. These are prohibited under Mexican law and should be carefully drafted by lawyer in Mexico.

- Late interest fee. To create the right “incentives” for your customers, you start with late interest. You should consider anywhere from 18% to 24% per annum, which is legal, and fair. If nothing is provided, Mexican law grants only 6% per annum.

- Court costs and attorneys’ fees. If you must sue a debtor to force him to pay, the court may grant court costs and attorneys’ fees. The court will grant anywhere from 7% to 10% of the outstanding claim if nothing was provided in the contract. If you are paying 20% to 30% for litigation, doesn’t it make sense to have your debtor compensate for that? This is fair, and legal. You can and should provide for that in your contract.

- Liquidated damages. Under Mexican law, debtors must pay damages for breach of contract, whenever they are caused. If there are damages to be caused by such breach, you can and should liquidate them ahead of time, or provide an easy formula. Proving damages in litigation is hard and time-consuming.

- Security and guarantee devices. A personal or corporate guarantee, a non-possessory pledge (security interest) and title retention, are simple clauses that can be easily incorporated into a credit application. These are effective to mitigate risk on trade credit in Mexico and should be used whenever possible.

One final word. The customer should sign the credit application by a legal representative. You can confirm his authority with your due diligence work, or by asking a good friend to help you “get the facts”. You should request the original signed document, making sure that the signature is genuine.

Sales documents as evidence for a potential debt collection case

Sad stories in Mexican courts are due to one main reason: lack of appropriate evidence to support a case. To win a collection case a seller needs to prove the following: 1) that there was an offer to buy or to sell goods, 2) that there was acceptance to that offer, 3) the specific terms and conditions applicable to that sale, and 4) that the seller performed on the contract according to the agreed terms. A Mexican court must find that the plaintiff has “fully” proved the merits of its case to grant judgment. The specific documents that help satisfy such a burden of proof and, therefore, should be well kept as evidence, are the following:

- Credit application. It must include terms and conditions of sale and all other items recommended here.

- Bills of lading. Bills of lading prove that the seller performed on the contract by delivering goods, as requested by the buyer. The bills of lading from the freight forwarding companies are the easiest to get, as signed delivery receipts are impractical, difficult to get. Sellers should keep their own sets of original bills of lading and request an original signature from the driver of the carrier companies upon picking up goods

- Purchase orders. Since faxed orders under prospect’s letterhead are a thing of the past, the seller should aim at getting these by email, scanned properly after being signed by an individual with authority within the buying company to place such orders.

- Invoices. Authentic invoices will support the fact that under the seller’s accounting books, the sale was made.

- Shipper imports. Sellers should try to get copies of the Mexican shipper imports (pedimento de importación) from the buyer pertaining to the import of such goods. If a copy is not available, the seller should obtain the name of the custom’s broker retained by the buyer who assisted with the import. He will be an important witness to confirm the purchase, receipt, and import of goods by the buyer.

- Acknowledgments. The seller should have a practice of getting emails or letters from the buyer where he confirms or acknowledges that certain goods were purchased, received, and imported by the buyer. Outstanding balances should also be confirmed in writing regularly.

Bear in mind that it is highly recommended to keep originally signed (authentic) documents. All individuals involved with issuing, accepting, and signing such documents should be clearly identified and pointed out.

3. Add security, including collateral, guarantees, and options for legal action

Trade creditors looking to reinforce their position to a place where they cannot lose, can do it by securing their credit transactions. This means securing your “debt” in any of the different ways possible: by creating strong obligations on the debtor, by obtaining specific collateral, or by getting appropriate guarantees. Creditors can also shield themselves by creating wise options for legal action, as discussed below.

What do we mean by securing sales—and credit—transactions?

In most common-law jurisdictions, “secured transactions” refers to the law that governs security interests in personal property (or movable assets) to guarantee payment or performance of an obligation. The security agreement modeled after Article 9 of the UCC (Uniform Commercial Code) in the USA, and under the PPSA (Personal Property Security Act) in Canada, is by far the main security device. In other jurisdictions (such as England and China), the main vehicles for creating security interests in personal property generally take the form of a pledge or a [fixed or floating] charge.

From a practical standpoint and in the context of the Mexican legal system (as well as other legal systems from countries in Latin America), a loan transaction or credit sale is secured and, thus, a secured transaction exists not only when creditors obtain a security interest in certain assets, but also when they put in place contracts that create strong obligations from the debtor or from third parties which can be effectively and efficiently enforced.

For instance, while the pagaré is not theoretically a security device (in the sense that it creates a security interest in certain assets), it does add some level of security to a seller offering trade credit (or any lender that is looking to make a loan), as the pagaré will provide access to a privileged action where he will likely enforce the claim in a more effective and efficient way.

Cost-effective—and easy to use—security devices for trade creditors

Taking into consideration the broad concept of “secured transactions”, there are three easy ways to add security to your sales—and credit—transaction in Mexico:

- by asking for a personal or corporate guarantee from the owner, main shareholder, or controlling company of the buying company;

- by creating a floating lien through a pledge agreement or clause, which applies to all future goods sold, or by adding a title retention or conditional sales clause; and

- by requesting a pagaré from the prospect. (The pagaré is a promissory note that meets requirements under Mexican law.)

Pledges, title-retention, and guarantees

The guarantee, title-retention, and pledge can be included in the credit application as clauses. These will be effective as long as the appropriate signatures appear in the application. Title-retention clauses are recommended on sale of hard assets that are valuable and not for resale by the customer. Machinery and equipment are the usual focus of these clauses.

The pledge can create a security interest over categories of goods such as inventory and receivables. This is where this security device is helpful. Take note that a pledge clause or agreement that is not signed or ratified through a notary public will only be effective for sales transactions of up to around $80,000 US Dollars in value. (This value is tied to an official “investment unit” in Mexico that is updated periodically.) An effective pledge will allow for immediate repossession and sale of the collateral through a fast and reliable special proceeding.

Both the pledge and the title-retention clause require filing at a public registry (or through the new RUG system, as referenced above) to become fully effective. This filing will put third parties on notice of such floating lien (security interest) or title-retention in favor of the seller.

Pagarés

The pagaré will be signed separately. The issuance of this pagaré can be referenced in the credit application to put the buyer at ease. This pagaré is highly recommended because it will prove by itself that a legally valid debt exists and that the debtor has not paid. It will also allow collection or enforcement through an executory proceeding, which grants interim relief through an immediate order of attachment or seizure of assets. This is also a fast, reliable, and less expensive type of proceeding. (For recommendations on the drafting of pagarés (promissory notes) please refer to our article “Pagarés: Rules You Need to Know Now for Valid Promissory Notes in Mexico,” which includes an example format.)

It is highly recommended that a lawyer in Mexico assists with the drafting and execution (proper signature) of these security devices. You must make sure that these documents meet all the requirements under Mexican law to be enforced with no undue risk. A lawyer in Mexico will also be able to assist with all notarizations and filings necessary.

Higher-end security devices

Other types of security agreements recommended for higher-amount transactions or above-level risk include the guaranty trust (fideicomiso de garantía), mortgage (hipoteca), bonds (fianzas), title retention (also known as reservation of title or conditional sales clauses), etc. These should also be consulted with Mexican counsel. He should be able to advice further on the level of security that each security offers, time & cost for implementing them, and the efficiency and effectiveness of enforcement. Upon discussion with legal counsel you should also be able to identify what constitutes a “good security” based on the 4S structure: simple to take, simple to value, stable in value, and simple to realize. By assessing all these factors you will be able to decide and implement the most cost-effective security device for your level of transaction.

Adding wise options for legal action

Besides the different options of starting a lawsuit in Mexico, as afforded by the above-mentioned strategies and security devices, there is also the possibility to sue your debtor in a court of your home country. The objective here would be to enforce any resulting judgment through a Mexican court. To achieve this, creditors need to include a neutral or non-exclusive jurisdiction clause in your credit application. This could prove useful in cases where it is necessary to pierce the corporate veil, or when a particular Mexican jurisdiction is considered to be “unfriendly” towards complex issues such as those presented by an international sale of goods. An option for arbitration can also be included in your credit application for similar reasons, to be used alternatively based on strategy.

Different factors will ultimately decide whether you should opt for arbitration or begin legal proceedings in a Mexican court or in your own jurisdiction. You must also heavily assess whether you should include at all a neutral or non-exclusive jurisdiction clause and/or an optional arbitration clause, and the specific matters that these clauses will apply, or be excluded from. This will be a decision that will have to be upon discussion and thorough review with both legal counsels in Mexico and in your home country. Once decided and wisely chosen and implemented, you will be prepared with a number of weapons to offer your collection lawyer for a higher margin of success.

Conclusions

It is possible to sell in Mexico on open account credit terms and to do it successfully. To do this you have to create and implement a new credit and sales policy that will mitigate the risks associated with such international sales and secure trade credit effectively. Such policy should always include the following:

- conduct proper due diligence work on prospects and customers for credit analysis,

- use the credit application and sales documents effectively, and

- add security devices, collateral, guarantees, and wise options for legal action.

Provided that you’re able to implement a plan of this sort with the help of experienced lawyer in Mexico and in your home country, you will position yourself where you cannot lose, and you will be able to successfully not only enter the Mexican market, but to stay there and come out on top.