Empowering Creditors to Prevail in Lawsuits and Amicable Settlements

Summary: Navigating Mexico’s complex legal system to collect debt requires strategic preparation as creditors face a litany of challenges from courts’ inefficiencies to sophisticated debtors exploiting loopholes. This guide examines available legal actions while advising creditors on preparation and consideration of amicable collection efforts to avoid problems and liability. With wisdom and adapting to inconsistencies across jurisdictions, creditors and their lawyers in Mexico can craft optimal solutions to surmount obstacles and achieve favorable recoveries.

Introduction to debt collection in Mexico, from a lawyer’s perspective

Debt collection is a challenging process in Mexico. Legal inefficiencies, ineffectiveness, and sophisticated debtors adept at exploiting the system mean creditors face an uphill battle recovering owed funds. However, with the right legal preparation and strategic approach, favorable outcomes remain possible. This article outlines the complex terrain confronting creditors and provides recommendations to develop an optimal strategy based on understanding Mexico’s legal landscape. We examine amicable settlement avenues before litigation given the system’s deficiencies. We then overview available legal actions—from pre-trial options to secure evidence or assets to full commercial lawsuits—and highlight key procedural differences compared to the U.S. that affect outcomes.

With its formalism and delays, Mexico’s system requires creditors build a wise, cost-effective strategy suited to achieving collection goals, rather than relying on courts alone. By illuminating available tools and remedies, as well as risks and opportunities across jurisdictions, this guide aims to position creditors and their lawyers to craft bespoke solutions toward favorable debt recovery. The path ahead may be rocky, but knowledge and preparation empower strategic creditors to succeed despite the challenges.

Out-of-court (amicable) debt collection: collect safely & avoid the legal process

Before initiating any collection attempts, creditors must familiarize themselves with the complex web of laws and regulations governing and restricting such efforts in Mexico. Failure to adhere fully could trigger severe sanctions, fines, and even civil & criminal liability for creditors. Sophisticated debtors adeptly exploit regulatory gaps to launch counterclaims of impropriety and dishonest accusations against creditors or their lawyers for leverage and negotiation power. They may allege breaches without meaningful evidence, making vigilance essential for creditors.

Moreover, creditors must recognize Mexico’s unique legal and business culture shaping collection dynamics. Communication emphasis should be on good-faith discussion rather than overly aggressive demands. And possible settlement options require exploration and consideration given court inefficiencies. With preparation and cultural wisdom, creditors can approach the negotiation table to respectfully but resolutely represent their interests while searching for common ground.

Debt collection regulations

On September 2nd, 2015, Decree A/002/2015 was adopted by the Consumer Protection Office (“PROFECO”) to regulate debt collection practices by creditors and debt collection firms or lawyers in Mexico. These regulations impose important obligations, restrictions, and sanctions that creditors should be aware of regarding collection efforts in Mexico, including:

- Restrictions on contact times, allowing calls only on weekdays between 7am-10pm based on debtor’s time zone, to avoid early/late harassment.

- Requiring collectors obtain and provide documentation detailing the origins and calculations of debts claimed, to prevent unsubstantiated demands.

- Prohibitions on contacting third parties about debts or publicly disclosing debts, to protect privacy.

- Banning false documents or misrepresenting as government officials, to prevent deception and intimidation.

- Mandating respectful conduct without offensive language or threats, to avoid undue pressure.

- Imposing liability on creditors for violations by collection agencies they engage, to ensure oversight.

In contrast to the Fair Debt Collection Practices Act (FDCPA) in the U.S. which governs exclusively debt collectors (not the creditors themselves) and centers exclusively on consumer claims, Mexico’s debt collection regulations take a wider accountability approach in the following ways:

- Creditors. Obligations, restrictions, and sanctions are imposed not only on debt collection firms, but also on creditors. Thus, liability can be imposed on creditors for unlawful collection efforts from their collection agents.

- Commercial debt. Regulations apply not only to consumer but to commercial (B2B) debt as well. While the regulations could be considered intended for consumers, they are silent and do not clearly define their scope. Thus, commercial creditors should always consider obligations and restrictions imposed and, consequently, keep a close eye on the practices by their agents in Mexico.

- Foreign firms. The regulations protect consumers in Mexico. Thus, collection efforts in Mexico can and will subject foreign creditors to sanctions provided therein, even if firms retained to undertake these efforts are independent third parties. Yes, PROFECO has entertained claims against foreign firms in the past, so foreign creditors are not out of reach.

Other laws to keep in mind

- Specific crimes. Most states and the federal government have passed laws that criminalize “illegal” debt collection practices, which carries one to six years in prison. The intention is to prevent intimidation, harassment, or violence to collect a debt, or the use of false documents, such as seals or court documents for impact and deception (a recurrent practice that some collection firms used to follow).

- General crimes. Other crimes that are closely related to illegal collection practices and that constitute crimes include threats (“amenazas”), defamation (“difamación”), slander (“calumnia”), and extortion (“extorsión”), all regulated under state and federal law and usually punishable with prison.

- Privacy laws. In Mexico, debt collectors must adhere to regulations ensuring fairness, transparency, legality, proportionality, and accountability in handling personal debtor data. This involves respecting debtor dignity and privacy, avoiding harassment, and using data only for legitimate debt collection purposes. Collectors are required to verify debtor identity, provide comprehensive details like the name of the attorney or collection agency, account specifics, debt calculations, and complaint channels. Conduct during visits should be respectful, within working hours, and all payment plans must be properly documented. Unauthorized contact with third parties about debts is prohibited. Ensuring lawful justification for data processing, secure and minimized data retention, proper data transfer, and allowing debtor control over their data use are essential. Non-compliance risks heavy sanctions from the Mexican data protection authority INAI, as violating debt collection regulations typically translates to breaching Mexico’s privacy laws.

- Creditor’s laws. Creditors are also subject to liability imposed by their actions abroad under the laws of their own jurisdiction. In Mexico, attorneys and debt collectors must be aware of the legal implications their actions might have in these foreign jurisdictions. For instance, in the USA there’s a concept known as “tortious interference.” This occurs when wrongful acts or collection practices intentionally disrupt a debtor’s business or contractual relations, causing financial harm. Such actions can result in the creditor being held liable for damages. Practices like publicly tarnishing a debtor’s reputation or shaming them among suppliers can lead to damage claims against the creditor if harm ensues. Understanding these cross-border legal repercussions is crucial for creditors operating internationally, and for the law firms or collectors assisting them abroad.

Creditors must carefully scrutinize and monitor any third-party collection agencies or lawyers retained to ensure full adherence to Mexico’s complex web of laws governing recovery practices and personal data usage. Negligent or deliberate violations by uninformed agents can still expose creditors to severe civil, administrative, or even criminal penalties. Furthermore, sophisticated debtors exploit legal missteps to threaten counterclaims or extract settlements from creditors, even questionably. Hence, for risk mitigation, creditors should exercise great discretion and caution in selecting knowledgeable partners intimately familiar with Mexico’s intricate regulations and zealously compliant to avoid infractions. Prudent partner choices and understanding jurisdictional variances allows designing evidence-based collection approaches to each unique situation, while avoiding potentially disastrous regulatory violations. The path ahead may be rocky, but wisdom makes creditors unstoppable.

Demand letters: misconceptions, practices, and legal strategy

Unlike some other countries or jurisdictions, a demand letter or formal notice against the debtor is not required before suing him in court, except in some cases. For instance, if there was no agreement as to the date or place of payment of the obligation, the creditor must make a formal demand. Also, if there is an assignment of the debt from the creditor, the assignee must provide formal notice to the debtor and demand payment before filing legal action.

While demand letters are widely popular in the USA and in other countries during debt collection efforts, we seldom see these as effective compelling tools to persuade a debtor to pay, unless the demand is made through a notary, or through the courts. This is probably because this formal demand usually signals to the debtor that the creditor is “preparing” litigation and is not simply standing back and waiting. This sometimes triggers at least a discussion of the debt, which is the opportunity that creditors seek to negotiate, settle, and avoid litigation. A few remarks should be made on these demands (for full information on formal demands please refer to https://hmhlegal.com/blog/demand-letter-of-payment-in-mexico/):

- Formal demand through the courts. A demand through the courts stops the limitation period for filing a claim, which is renewed afterwards. If claim expiration is a concern, this is the way to go. These also carry a bit more weight, in terms of credibility and certainty. Two offsides: 1) the process is slow, taking weeks or months to accomplish, and 2) a power of attorney with hefty requirements is needed.

- Formal demand through a notary. This is the quickest and most efficient method. It is accomplished in a matter of days and a formal power of attorney is not needed. The offside is that notary demands do not stop a limitation period unless the debtor acknowledges the debt in front of him. An acknowledgement of debt with the notary or through the courts gives creditors a privileged executory action against their debtors.

Legal collection (litigation): what to expect from the Mexican legal process

While I wish I could say that the Mexican legal system is flawless, the reality is that it faces real challenges. Enforcing legal claims requires sound laws and a reliable & efficient court system. Unfortunately, Mexico’s court system and, the legal process specifically, can be slow and inefficient at times, as is the case across much of Latin America. Moreover, corruption still plagues certain jurisdictions, undermining institutional trust at times, as retired Supreme Court Justice Arturo Zaldivar recently attested. Thus, Mexico has fallen to 126th out of 180 countries surveyed in Transparency International’s latest 2023 Corruption Perception Index, which evaluates corruption perception across the world.

However, these issues do not prevail uniformly across all states and courts. The risks and opportunities vary across different jurisdictions. Despite the challenges, Mexico’s legal system ultimately functions and claims can still be enforced with a thoughtful strategy and legal counsel: knowing which courts to avoid and where best to file suit, which remedies work most effectively, how to prevent unnecessary delays, along with fully understanding the legal process with its nuances across jurisdictions, and clearing misconceptions that could undermine approach choices, represents key knowledge empowering creditors to craft an optimal solution.

I offer this open assessment not to discourage creditors from pursuing claims, but to promote a full awareness of the risks so claimants can build an optimal strategy that exploits opportunities within the system. Success requires thoroughly understanding Mexico’s complete legal process—from filing a complaint to executing judgment—and the remedies available both in court and out-of-court. Only with that knowledge can an effective strategy be crafted to meet one’s goals as efficiently as possible. (For more information on assessing litigation in Mexico and building an effective strategy please refer to our article available at https://hmhlegal.com/blog/litigation-in-mexico/.)

In summary, while Mexico’s system has flaws, strategic creditors can still achieve favorable outcomes through preparation, understanding and planning.

Stages in the legal process until collection

The legal dispute resolution process in Mexico proceeds in two overarching phases: an initial adjudicatory stage, followed by an execution stage. The adjudicatory stage encompasses procedures driving towards a conclusive ruling on case merits – whether the defendant actually owes payment obligations to the plaintiff creditor, for instance. This segment involves plaintiff pleadings, service of process, defendant responses, evidence offerings and disclosure by both sides through interim and final hearings and culminating legal arguments or conclusions prior to the judge rendering final judgment.

Should creditors secure favorable money judgments, the secondary execution phase aims to satisfy the judgment by liquidating debtor assets. A range of mechanisms exist – creditors can freeze bank accounts or garnish rights belonging to the debtor (like those from private or government contracts, receivables, trademarks, patents, etc.), put liens on real estate, seize and repossess movable assets (inventory, machinery, equipment, etc.), and even seizing entire companies as court-supervised bailees acting as receivers assume control. But countless procedures accompany execution in Mexico, offering opportunities yet also delaying ultimate collection. The two stages can operate linearly, with execution only pursued after the judge definitively rules for the plaintiff. Nonetheless, certain actions permit creditors to launch parallel early attachment against assets to secure eventual repayment pending case outcome. When properly structured, a good strategy by creditors and their lawyers can exploit both routine linear staging and tactical shortcuts to accelerate relief.

The following image illustrates the two stages usually present in the legal process:

But a final judgment is not considered “final” until there is no recourse pending that can overturn or nullify the decision from the judge. In legal terminology, this state is referred to as “res judicata,” indicating that the case is conclusively closed and the same issue can’t be brought back to court or relitigated by the same parties. It’s about preventing endless legal battles over the same issue.

However, to reach res judicata finality, a grueling, treacherous, and long road must be pursued and conquered. Parties have opportunities to appeal the final decision from the first instance court. And then litigants can also challenge the appellate judgment through another legal action known as amparo. The procedural stages unfold as the following illustration shows:

Since amparo is unique as a creation of Mexican law, an explanation is warranted. An amparo is a constitutional injunction proceeding that can supersede any other type of proceeding or resolution. An action of amparo can be filed whenever a fundamental human right provided under the Mexican Constitution or under an international treaty that Mexico has subscribed, is allegedly breached or infringed by any government agency or institution, including courts. This is not a legal remedy within a certain civil or criminal case but, instead, it’s a different and independent proceeding. Amparo provides relief across spheres, challenging government conduct including arrest warrants, interim orders, and any final judgment (civil, commercial, criminal, etc.). In the latter cases, an amparo could be thought of as a “third instance appeal,” as it allows challenging a final judgment after an ordinary appeal has been exhausted.

But these amparo proceedings are very technical in nature and, thus, few amparo awards are granted. Only in those cases where there is clear evidence that there was a violation of fundamental rights will a district or circuit court grant an amparo award. This denial, however, doesn’t stop the delay that such amparo proceedings bring along, although they tend to be faster and more efficient each day.

Importantly, execution against debtor assets can actually begin before a final judgment is reached. Some cases exist focused singularly on encumbering assets early in a dispute, during service of process (an example is the executory process, described below). But some preliminary actions allow prejudgment attachment orders to secure relief while the main lawsuit gets underway. These actions require that creditors immediately follow up by filing their main action through a formal complaint, after assets from the debtor are seized. This preliminary stage is a critical aspect of a creditor’s strategy: he must position himself to access executory proceedings (and preliminary execution orders thereof) through secured contracts and, when not available, seek preliminary actions that will grant access to this preliminary relief. The following image depicts how a preliminary execution would run parallel to the main case:

Key differences in Mexico’s legal system that impact litigation

Some key differences between the American legal system (common law tradition) and the Mexican legal system (civil law tradition) that I believe impacts heavily on these cases, are the following:

- Pre-trial discovery. Unlike the U.S., in Mexico there is no pre-trial discovery. Thus, creditors will not be able to go into a “fishing expedition” to gather evidence to strengthen a case. In Mexico, you start litigation with whatever evidence you have, and you are not allowed to offer evidence obtained afterwards, or to amend your complaint, with limited exceptions. Thus, you must be well prepared for a legal battle before starting it. Should a creditor fall short of necessary or strong evidence, preliminary actions can help strengthen a case and should be pursued. (More on preliminary actions below.)

- Pleading requirements. Under current U.S. law, the Federal Rules of Civil Procedure mandate a simplified approach to pleadings. The primary requirement is a “short and plain statement of the claim” that shows the plaintiff is entitled to relief (Rule 8(a)(2)). This ‘notice pleading’ approach focuses more on providing sufficient information to notify the defendant of the claim and its basis, rather than detailed factual presentations, avoiding overly burdensome detail. In contrast, Mexico’s more formalistic system requires detailed specificity and exhaustiveness in complaint pleadings, demanding particularity at all times. In addition, the offering of evidence in most cases must be incorporated into the initial complaint pleading, as subsequent offers of evidence or attempts to amend the pleadings are typically rejected, with limited exceptions. This renders the initial complaint pivotal to a plaintiff’s case. Simply, it is what “makes or breaks” the plaintiff’s case. Thus, it is crucial for creditors to critically evaluate legal counsel before initiating litigation in Mexico and fully support this part of the process.

- Standard of proof. In the U.S., the standard of proof in most civil cases is “preponderance of the evidence”: you prove your case if you can prove that your claim is more likely true than not. Claims of fraud have a higher standard of “clear and convincing evidence.” Criminal cases require the highest standard: “beyond a reasonable doubt.” In Mexico, to prove your case the judge must have “intimate conviction” that the facts support the claim. The law requires all facts in a claim to be “fully” proved. While it is difficult to translate this threshold, it falls between the “clear/convincing” and “reasonable doubt” standards in the USA. This oversimplification is only offered for brevity’s sake. (Please note that “documentary” evidence will always be key in these cases.)

- Legality principle. Legality (“principio de legalidad“) is central to the Mexican legal system. It is grounded in the Constitution and shapes the legal framework and judicial approach in the country. Legality ensures legal certainty and security, protecting individuals from arbitrary actions by the state. It mandates strict adherence to legal forms, with a dogmatic approach prioritizing the literal application of laws. This often overrides considerations of justice, fairness, or common sense, as justice is seen as being achieved through the exact application of the law. This results in a highly formalistic system, where procedural formalities are crucial, often leading to delays and inefficiencies in litigation. This contrasts with common law systems like the U.S., where judicial discretion plays a more significant role.

- Service of process. Governed by rigorous procedural rules rooted in Mexico’s strict constitutional legalism, service of process is treated as an almost sacramental ritual – far more formalistic and stringent than the United States, where private process servers are allowed (but not permitted in Mexico). This ritualistic approach, zealously safeguarded by federal courts to protect defendants’ rights, demands flawless execution of intricate procedures, with even minor infractions leading to nullification and full restart when due process appears threatened. Logistical impediments abound, most notably reliance solely on overwhelmed court clerks who bear exclusive responsibility for serving notifications amid already strained workloads, causing delays. Evasive debtors dodging service attempts, coupled with risk-averse clerks avoiding imperfect notifications due to liability concerns, exacerbates challenges. This convergence of constitutional veneration of formality, procedural complexity, administrative capacity constraints, perverse incentives, and liability avoidance creates a pivotal pain point for creditors and their lawyers. While well-intentioned, the system’s rigor inadvertently advantages debtors strategically. Hence, creditor creativity and preparation becomes vital to successfully navigate this key aspect of Mexican legal proceedings. Still, with persistence and strategic partnerships with experienced Mexican lawyers, creditors can achieve proper service despite the myriad impediments fused into the process.

- Limitation period. Statutes of limitation in common law jurisdictions like the United States are procedural rules barring (preventing) legal remedies after defined deadlines, whereas civil law prescription treats exceeding statutory time periods as extinguishing the underlying substantive rights. Hence, missing a limitation deadline merely blocks the court claim while prescription actually terminates the rights. This affects choice of law – U.S. courts apply local limitations regardless of the governing law, while civil law assesses prescription under that law. In addition, these time periods are usually shorter in common law systems. Consequently, a U.S. creditor suing a Mexican debtor must strategize legal action per both laws. As illustration, California generally requires filing debt lawsuits within four years, while Mexico allows ten years for the same debt claim. Careful planning regarding timing, jurisdiction, and governing law of disputes is essential in cross-border transactions. Proper legal advice is crucial from transaction inception through filing suit to ensure adequate preservation and enforcement of claims in appropriate venues.

- Other differences. There are countless differences between Mexico’s civil law system and the American common law tradition that impact litigation, but I will focus on a few key variables that affect legal processes for creditors.

- Division of jurisdiction. Unlike the unified court system in the U.S., Mexico has separate sets of courts with distinct jurisdictions, including ordinary courts that handle civil and criminal cases, and other specialized courts for labor, agrarian, administrative, and constitutional maters, including amparo. Moreover, ordinary courts separate civil and criminal matters with distinct procedures, judges, and judicial authority. For instance, a civil judge has limited power to sanction perjury occurring before him, leaving it to the prosecutor to review further and prosecute through a criminal court.

- Contempt powers. Unlike common law systems, Mexico’s civil law tradition does not provide judges with inherent contempt powers or broad equitable remedies. The historical evolution of the common law saw English chancery courts develop principles of equity and tools like civil contempt to allow judges to mitigate the rigidity of strict legal rules. Mexican civil procedure lacks an equivalent institutional development. As a result, a Mexican judge hearing a civil case involving fraud cannot draw on contempt powers to personally compel a defiant defendant by means of jail time, as an American judge might.

- Bar membership. Unlike the U.S., Mexico is probably the only country in the world where bar association membership or examination is not required for legal practice. Upon finishing law school and obtaining a license from the Secretary of Public Education (SEP) following examinations, lawyers simply register their license with courts. Lacking any specific disciplinary procedures by SEP, attorneys largely self-regulate given limited and deficient accountability mechanisms by some States, compared to mandatory American bar associations enforcing strict ethical codes. This voluntary self-regulation enables misconduct that may escape sanction beyond potential criminal charges for unlawful acts. Hence lax formal accountability contributes to unpunished unethical attorney conduct during litigation.

- These combined variables allow lawyers to obstruct valid claims, harming creditors. Unavailable contempt powers, divided courts with restricted jurisdiction, and loose oversight of ethics facilitate lawyers advising debtors on denying debt claims, disobey orders, and appeal endlessly to stall cases deliberately until plaintiffs walk away from legitimate cases. Unintentionally, the system thus incentives abuse of the legal process in some situations, benefiting defendant-debtors.

Types of legal proceedings in Mexico

Except for the civil summary proceeding described below, all proceedings discussed concern disputes between parties considered merchants under Mexican law. Both federal and state courts have jurisdiction to resolve and adjudicate these commercial disputes. As commerce constitutes a federal matter in Mexico’s legal system, the federal Commercial Code governs business transactions as well as related litigation procedures nationwide. Therefore, these commercial proceedings apply to most disputes arising from international trade, sales, loans, investments, and other transactions among companies or businesspeople.

- Ordinary proceeding. Used less frequently due to the expansion of oral proceedings, the ordinary proceeding in Mexico remains relevant for complex cases that fall outside the scope of oral or other specialized proceedings. While theoretically allowing comprehensive evidence discovery, in practice these cases progress slowly, often taking 2-4 years to reach a final judgment. The burden of proof is entirely on the plaintiff to gather and submit evidence to support the claims. Cases turn more challenging for plaintiffs lacking solid documentation like contracts and written communications. While the lengthy timeframes and evidentiary burdens frustrate some foreign litigators, the ordinary proceeding remains the most widely used civil action. Since January 26, 2020, most commercial cases now fall within the scope of oral proceedings. Only cases with no monetary value, such as actions for pure declaratory relief including nullity actions, continue to be handled under ordinary proceedings.

- Oral proceeding. As part of judicial reforms aimed at making the administration of justice faster, less costly, more transparent and, to some extent, more adversarial, Mexico has implemented oral proceedings across most commercial disputes. Whereas ordinary proceedings center on written filings (with secretaries usually sitting on behalf of judges during hearings), oral cases feature witness testimonies and arguments by parties and counsel delivered verbally in front of judges, with decisions rendered orally by judges immediately after a final evidentiary hearing. Oral actions thus increase public visibility and interaction between parties, attorneys, and the judge. While reducing case timelines compared to traditional litigation, oral rules remain vague in places, granting considerable discretion to judges to shape procedures. With open hearings and live witness examinations, oral proceedings now resemble civil trials in the United States more closely than other Mexican proceedings.

Do oral proceedings work? It is still a work in progress. While oral proceedings have delivered speedier resolutions, the quality of justice has at times suffered in the faster process. Whereas judges previously had months to issue written rulings which allowed depth of judicial analysis and justified decisions, now their rulings come immediately after hearings, leading to concerns about well-reasoned judgments losing out to expediency. - Oral executory proceeding. Oral executory proceedings are a subset of oral proceedings, which apply when plaintiffs hold debt instruments like promissory notes establishing a legal presumption of validity. This shifts the burden to defendant debtors to produce exonerating evidence rather than requiring creditors to prove every claim element. Allowing prejudgment attachment of assets, oral executory cases aim to facilitate decisive enforcement of debts while adopting oral proceedings’ transparency. Contested cases typically conclude within 1-2 years from filing to final judgment, significantly faster than ordinary commercial litigation. At present, only disputes involving amounts ranging from MXN $851,710.18 (approximately USD $51,745) to MXN $4 million (roughly USD $243,000) are subject to oral executory rules. Debt claims that do not meet or that exceed this threshold are required to undergo a written executory process, as detailed below. (There is an important caveat here regarding attachment timing: the order to seize assets is executed only upon proper service of process on debtors is completed. And as previously discussed, meticulous service often proves an imposing initial hurdle given legal formalities. Thus, advanced attachment through preliminary actions prior to pursuing an oral executory proceeding may better position creditors.)

- Executory proceeding. A legacy written procedure for commercial debt collection matters, executory proceedings maintain written filings but still limit defendant defenses and allow prejudgment attachment orders to secure assets pending judgment. Executory proceedings offer quicker, more decisive debt enforcement compared to ordinary proceedings. The essence is facilitating seizure of assets when the plaintiff holds special debt titles (such as promissory notes), shifting most burdens of proof to the defendant, who have limited defenses and objections only related to the debt title and not regarding the underlying claim, with limited exceptions. Executory cases usually resolve in 1-2 years. At present, only disputes involving amounts of at least 4 million pesos (approximately USD $243,000 today) must follow the traditional written executory proceeding. (The caveat referenced for oral executory proceedings applies here as well given initial attachment timing upon notification completion.)

- Special proceeding. Statutory special proceedings delineated in Mexico’s federal codes expedite enforcement in targeted situations like collateral obligations. For instance, the Commercial Code establishes a streamlined judicial process for creditors to swiftly repossess assets pledged as loan collateral through non-possessory pledges and guaranty trusts. Upon filing a complaint meeting all legal requirements, the judge must order the immediate repossession of collateral against the debtor within two days. Attaching the latest account statement furnished to the debtor creates a presumption of the outstanding balance if unobjected to within ten days of receipt, shifting the evidentiary burden of disproving sums onto defendants. Moreover, only a few narrow documentary-supported defenses are permissible, like lack of signature, altered documents, or proven debt cancellation. By concentrating directly on collateral obligations, these special proceedings allow swift prejudgment seizure orders while limiting debtor objections. This facilitates efficient repossession and liquidation of pledged security assets compared to general commercial litigation.

- Stipulated or conventional proceedings. Beyond codified special procedures, Mexico’s Commercial Code enables parties to stipulate tailored expedited actions through agreement. Here, parties can stipulate and customize proceedings with reduced filings, limited evidence restrictions, abbreviated terms or excluded appeals. Resembling arbitration in some ways, stipulated proceedings preserve judicial oversight while granting significant process flexibility over ordinary lawsuits. A wise creditor strategy involves selecting a normally available special or executory proceeding as a model while eliminating unnecessary steps that otherwise invite inefficiency. However, stipulations must still respect “essential” formalities constituting due process rights that cannot be waived or ignored. But within those guardrails, party-crafted protocols can significantly expedite most disputes compared to regular commercial litigation. Though requiring more deliberate crafting and wise customization, stipulated proceedings fosters major efficiency gains, as well as effectiveness.

- Small claims court or fast-track? No. Except for strictly “civil claims”, that is, claims that do not derive from a commercial or business relationship, and available only in some jurisdictions (known as “Justice of the Peace”), Mexico has not established dedicated small claims courts and does not have fast-track or monitory proceedings as in most European countries or other countries around the world. However, streamlined oral proceedings now hear most minor commercial cases, functioning similarly to small claims courts in the United States by relaxing procedural complexities to improve access to justice and efficiency for lower-value disputes. With simplified rules and limited hearings, oral commercial proceedings provide quicker, more affordable resolution of smaller claims. Still, I have a hard time recommending any businessperson to file a complaint to demand payment through an oral proceeding alone, as formality and the technical nature of the legal process is simply overwhelming for someone without professional legal knowledge and some experience in the courts. Bottom line, creditors will still need the help of a lawyer to pursue small commercial claims in Mexico. In the case of strictly civil claims, creditors might want to look for justice of the peace courts, although the threshold is usually very low. At present, these courts in Baja California will only hear claims worth MXN $103,740.00 (approximately USD $6,325) or lower.

- Civil summary proceeding. While not commercial litigation, the specialized civil summary proceeding expedites mortgage enforcement for creditors securing debt obligations using collateral real estate. However, mortgage enforcement falls under state law and, thus, creditors will exclusively use state courts, whose efficiency varies significantly across Mexico’s justice system – meaning venue selection strategy is pivotal. Without properly perfected mortgages matters revert to ordinary multi-year civil litigation. Contested civil summary foreclosures typically resolve within 1-3 years instead of 2-4 for ordinary civil litigation in Mexico’s overburdened civil court systems across states. So, if foundational mortgage contracts prove deficient, the accelerated process and supposed advantages dissipate. But when rigorously constituted and customized, registration-perfected mortgages authorize accessing civil summary avenues that streamline foreclosing on secured real estate assets, becoming truly effective when paired with a reliable court.

Enforcement of foreign judgments and arbitral awards

The enforcement of foreign court judgments or arbitral awards in Mexico, follows distinct processes under Mexican law. Obtaining recognition of a foreign judgment in Mexico’s court system (known as exequatur or homologation) involves a complex, formalistic procedure with uncertain outcomes. By contrast, the enforcement of foreign arbitral awards is more straightforward and predictable thanks to Mexico’s adoption of international treaties that facilitate the process.

To start homologation, the foreign court must issue a formal letter rogatory which must comply with rigid authentication requirements and other sacramental formalities under Mexico’s legal system. Key steps include legalizing documents with apostilles, translating everything into Spanish, and providing statements confirming the finality of the judgment, reciprocity, jurisdiction, etc. Once submitted to the court, the petition follows a summary proceeding where the judgment debtor can oppose enforcement on grounds related to jurisdiction, due process, public policy, etc. A judge then rules after an expedited review process. The heavy formalities and unforeseen defenses at this late stage introduce significant uncertainty into successfully enforcing a foreign judgment in Mexico.

Meanwhile, the enforcement of foreign arbitral awards follows a clearer route based on Mexico’s adoption of the major international arbitration conventions. As a party to the New York and Panama Conventions, Mexico adopted streamlined procedures for recognizing awards issued abroad. To initiate enforcement, the winning party simply files a request attaching the original award and the arbitration agreement. The court then notifies the debtor and conducts an expedited hearing process.

More importantly, the defendant can only raise a narrow set of objections to defeat confirmation of the award, such as invalidity of the arbitration clause or violations of due process rights. Mexican courts cannot review the merits or scrutinize the arbitrators’ procedures and evidentiary decisions. This system grants significant protections and predictability to the award creditor.

While both processes are governed by their respective legal frameworks, the enforcement of arbitral awards in Mexico tends to be more predictable and less cumbersome than the enforcement of foreign judgments. Thus, those engaged in international business should consider arbitral clauses in cross-border agreements and transactions involving Mexican counterparties to ensure cost-effective enforcement of any resulting award. Relying solely on foreign judgments will prove riskier if disputes arise that require an enforcement process through the Mexican courts. For more detailed insights on the enforcement of foreign judgments, please refer to HMH legal’s article on that topic available at: https://hmhlegal.com/blog/enforcement-of-us-judgments-in-mexico-homologation/

Preliminary legal actions: settling or strengthening your case prior to litigation

Before initiating formal debt collection litigation in Mexico, creditors have several out-of-court and judicial options to pursue payment from a delinquent debtor. These alternatives aim to obtain critical evidence, secure assets, or compel the debtor to acknowledge and address the debt. While less costly and faster than lawsuits, preliminary actions carry varying degrees of enforceability.

Actions out of court

- Mediation. By retaining certified private mediators linked to government dispute centers, creditors can formally invite debtors to binding settlement talks via official stamped notices. If accepted, mediators facilitate negotiations exploring compromise, either remotely or potentially after conducting in-person inspections. Reaching agreements makes any payment promises as enforceable as court judgments, should debtors breach the agreement. However, debtors cannot be compelled to mediate; many sophisticated parties refuse, to their advantage. Thus, success remains contingent on voluntary participation. But properly structured mediations still enable swifter, lower-cost recovery resolutions compared to litigation. And regardless of immediate results, official approaches signal creditors’ firm commitment to resolving debts without litigation.

- Administrative claims. Certain Mexican government agencies facilitate conciliation processes between consumers and regulated entities like banks, insurers, or commercial suppliers. Accordingly, two tailored administrative complaint avenues exist. The consumer protection office PROFECO confronts unscrupulous domestic merchants through amicable conciliation proceedings aimed at settlement. Meanwhile, CONDUSEF fields claims against financial service providers like banks and insurance companies who have evaded obligations or delay resolution. Launching timely complaints halts limitation periods for legal action and compels the defendant to produce required and requested evidence during these administrative proceedings. Though uncooperative entities can await litigation absent agreements, properly filing a claim through administrative proceedings still signals a creditor’s unwavering commitment for resolving debts while securing additional evidence from sophisticated counterparties through help and a little bit of pressure from government agencies.

- Petitions to Transparency. Public information requests to federal and state government agencies help investigate government contractors indebted to commercial creditors. While confidential personal financial data remains restricted, transparency petitions can reveal a debtor’s dealings and potential contractual rights (including receivables) for upcoming attachment or garnishment, particularly through disclosures from debtor-facing governmental departments. In cases where a creditor has a claim against a government agency, public information requests can help validate and confirm such obligations, which becomes strong evidence in support of subsequent legal action against such government agencies. While transparency petitions investigate public records rather than provide directly enforceable orders, nonetheless, evidence and discoveries uncovering assets or obligations can crucially secure future enforceable judgments or execution enabled by initial transparency probes.

Actions through the courts

- Pre-Judgment Attachment. In Mexico, creditors can file for a pre-judgment attachment as a preliminary action in debt collection. This allows them to encumber or seize a debtor’s assets before formal litigation begins. The process involves posting a bond to cover potential damages if the creditor’s claim doesn’t succeed. Notably, debtors aren’t notified of these ex parte proceedings until after the order is executed, and creditors must file a formal complaint and start litigation within three business days. Even without specific banking details, creditors can freeze debtor bank accounts. But other assets could be encumbered and garnished as well, such as real estate, personal property (inventory, equipment, machinery, etc.), and other valuable rights including contractual rights and receivables. This preliminary remedy is a powerful tool in ensuring that assets remain available for recovery while compelling or persuading debtors to negotiate and settle, increasing the likelihood of successful debt collection in Mexico.

- Personal Restraining Order. By petitioning courts, creditors can restrict debtor company leadership from fleeing court jurisdictions until litigation concludes. These orders are helpful to try to secure payment of the debt before a final judgment is obtained, by preventing the debtor from potential flight and avoiding service of process or execution. However, creditors must post a bond to guarantee payment of possible damages and immediately follow restraining orders by filing a complaint and starting litigation within three days. Penalties for violating the court order fall upon individuals (debtors’ representatives) and may not necessarily generate creditor payment a priority. Still, even if restraint durations prove brief while litigation begins, such demonstrations of court-supported restraint help counter perceptions of dormant creditors unable to compel any engagement. Thus, restraining orders provide measured participation incentives despite limited individualized enforcement weight. In that sense, a successful order may be effective in creating debtor incentives towards negotiation and settlement before the litigation process is started or concludes.

- Proceedings for Acknowledgment of Debt. Preliminary petitions summon debtors before courts solely to acknowledge or deny outstanding payment obligations, without yet pursuing litigation or enforcement. Attending debtors first face potential perjury charges for providing false statements in denying a claim. Debtor non-appearances leave them legally presumed as acknowledging debts by default. Thus, these proceedings generate debtor responses facilitating negotiated settlements from complying participants or, potentially, secure an acknowledgment enforceable through executory proceedings from absentees and from those who expressly acknowledge the debt in court. Either way, these petitions strengthen the creditor’s position and allow him to assess next litigation steps. Essentially, through minimal initial effort, preliminary requests offer creditors clarity regarding likely litigation disputatiousness or chances for settlement.

- Proceedings to Obtain Evidence. By petitioning courts to subpoena traceable transaction records, documents, or tangible items from associated third-parties, creditors can secure foundational proofs for upcoming disputes without pursuing full litigation initially. Brokers, shippers, contractors, and other auxiliary parties having useful information on debtors face formal judicial orders compelling disclosure of evidence, though debtors can also be targeted. While these requests alone cannot deliver comprehensive enforcement or collection absent settlement, they develop critical evidentiary foundations to reinforce future legal actions. Compelling the release of financial records and documents detailing debts or underlying transactions, even from initially reluctant parties, these petitions provide key leverage by uncovering necessary details and evidence that creditors are missing and that debtors failed to furnish voluntarily.

- Injunctions. In Mexico, a preliminary injunction is a versatile legal tool, applicable in various situations. This injunction aims to maintain the current situation (status quo) by preventing debtors from undertaking specific actions that could harm the creditor. It includes prohibiting the sale of particular assets or goods, restricting transactions with certain customers or markets, and imposing limitations on the use of trademarks or any intellectual property. The injunction can also involve a preliminary filing of lis pendens on disputed real estate. This proactive step is instrumental in preventing conduct by the debtor that could be detrimental to the creditor, offering a strategic advantage by safeguarding the creditor’s position in any future litigation. To obtain these court orders, creditors must provide strong evidence and post a bond. Although they don’t automatically prioritize repayment, they compel the debtor to participate in legal processes and prevent the dissipation of assets, enhancing the likelihood of successful debt collection.

The challenge: legal representation in Mexican courts

Unlike certain foreign courts, legal counsel cannot simply appear before Mexican courts on behalf of this client company as designated attorney-of-record, until a representative of the company appears in court, or legal counsel is granted such authority as representative. Formal proof of representation is required, usually through a power of attorney (POA). For overseas clients, securing a properly executed POA can prove challenging. The POA must be notarized under the regulations of the grantor’s jurisdiction, accompanied by corporate records verifying the status of the granting company along with authorization from the signing officer. Certifying these foreign documents demands extensive international legalization procedures in some cases.

Moreover, many jurisdictions restrict notarial capacities validating out-of-country corporate identities as strictly as Mexican courts demand, much less certifying anything. Between logistics delays and engaging lawyers on both sides of the border for certification, obtaining a usable POA often entails months of work and major expense merely to appoint counsel.

A handful of Latin American countries can leverage the Protocol on Uniformity of Powers of Attorney to be Used Abroad of the Pan-American Union (also known as the Washington Protocol of 1940) to streamline cross-border powers of attorney. As a signatory, the United States also enables simplified rules for companies issuing a POA within its territory for use in Mexico. But for most foreign corporations located outside the Protocol’s limited American sphere, meeting Mexico’s rigid civil code mandates persists undiminished.

Unable to access the Washington Protocol, some foreign companies attempt securing powers of attorney through Mexican embassies and consulates internationally. Complex verification of overseas corporate documentation makes preparing a compliant POA tedious for diplomatic staff, despite their legal obligation. Unlike a locally issued POA (where the grantor is a Mexican corporation), embassy granted POAs still require extensive overseas proofs behind authorities and identities, which Mexican bureaucrats remain unaccustomed to reconciling from afar. Thus, many consulates and embassies simply deny non-national requests or the service offering in general, given limited capacities for managing external records, rather than citing legal constraints per se. Hence, pursuing embassy routes seldom resolves the underlying POA puzzle for most foreign companies needing representation.

To accelerate filing claims, an “assignment” of claim rights from the overseas claimant to a designated Mexican individual provides an alternative. The assignee can then sue locally under their own standing without formally demonstrating the foreign entity’s corporate approvals. This assignment functions as a limited rights transfer via an assignment letter signed before two witnesses. However, assigning claim rights forfeits client flexibility and strategic control compared to holding a valid POA. And rights still ultimately revert to the originator upon conclusion of litigation initiated through assignment, as long as this is specifically provided for in the agreement justifying and supporting the assignment, as well as protecting the assignor. But for expediency bridging the gap until attaining regularized POAs, assignments can facilitate filing initial petitions and complaint pleadings.

Recent trends and opportunities

Navigating Mexico’s rigid legal system, creditors face challenges in debt recovery, yet recent progress sparks optimism. Innovations like electronic case management and simplified bank account garnishment procedures, alongside varying court performances across the country, provide opportunities for effective strategies despite inconsistent application. These advancements signal a shift towards better creditor accessibility, promising improved outcomes for those skilled at utilizing these tools. This evolving legal framework, with its emphasis on technological progress and nuanced procedural reforms, equips creditors to navigate and overcome traditional hurdles more effectively. Clever lawyers, recognizing these opportunities, can develop strategies for successful debt enforcement against sophisticated debtors within this complex yet modernizing legal environment.

e-Justice: ability to file and monitor cases online

Back in 2020, amid the chaos of the pandemic, Mexico’s federal judiciary implemented an innovative online platform to modernize and expedite civil and commercial litigation nationwide. This digital system brought several key advantages that remain relevant today. It enabled the continuous administration of justice while adhering to health precautions, reduced backlogs, and increased participation through remote accessibility.

The portal allows litigants to file complaints and motions electronically, track cases in real-time, receive online notifications, and attend hearings via videoconference. According to legal scholar Miguel Carbonell, these online justice systems have three primary benefits—lowering costs by limiting legal fees and filings; modernizing and accelerating often extremely lengthy proceedings; and expanding access to justice by utilizing new technologies.

I can personally attest to the system’s advantages. In 2023, my Tijuana-based firm filed a debt collection case against a debtor in Aguascalientes entirely online. Within three days, the court admitted the complaint, scheduled a hearing, and authorized our videoconference participation for the proceedings. The court clerk promptly notified the debtor in person. At the hearing, the debtor’s representative appeared in court while we examined him remotely. Just a few weeks after the hearing, we secured a settlement and payment, avoiding further litigation or asset seizure. Everything was done from the comfort of our office, without printing any papers or visiting courts. Yes, this was an exceptionally smooth case (out of many), but it comes to confirm that e-justice can deliver monumental efficiency and convenience, at least in some cases.

This case demonstrates that while still inconsistent, e-justice provides a glimpse into more modern, streamlined pathways for legal resolution. By enabling affordable remote enforcement of obligations without setting foot outside one’s office, Mexico’s digital court system brings welcome innovation, promising creditors potentially swifter pathways to justice.

The following edited video highlights moments from the hearing of the case referenced above, showing how online justice with remote interacting is possible.

Garnishment of bank accounts, including investigation of accounts

Historically, plaintiffs struggled garnishing Mexican bank accounts since court clerks executing seizure orders required specific account details for identification. However, in 2019 circuit courts in Mexico City confirmed creditors could encumber funds without such data in a landmark ruling. The precedent recognized informational barriers that prevented creditors from accessing debtor financial data due to strict privacy laws.

This breakthrough judgment was subsequently reinforced by a 2020 Supreme Court decision which confirmed, similarly, that to garnish bank accounts judges did not need to request account numbers or associated information of financial institutions of plaintiffs. Instead, the Court ruled that creditors merely had to declare under oath that they lacked any knowledge of other reachable assets belonging to the debtor.

For attorneys representing creditors, this development is a game-changer. It enables a more efficient strategy in pursuing debt recovery, as the need to identify specific banking information—a process often blocked by privacy regulations—is eliminated. By simplifying the garnishment process, the courts have effectively leveled the playing field, mitigating one of the debtor’s potential strategies to avoid meeting their financial obligations.

Furthermore, the logistical part has also been simplified for creditors. Upon filing a valid petition to the court, an order is issued to the National Banking Commission, who in turn sends multiple orders to all financial institutions in Mexico to freeze and report on debtor accounts, including account balances. Banks usually comply within the allotted timeframe to avoid strict sanctions by the court. This exemplifies a proactive judicial stance in favor of creditor rights. Not only does this ensure the immediate preservation of assets for potential recovery, but also imposes a significant deterrent against debtor non-compliance.

Attorneys can now leverage this legal framework to advise their clients more accurately on the likelihood of recovery, plan their legal actions with greater confidence, and execute judgment enforcement with increased effectiveness. This advancement underscores the importance of being well-versed in the latest legal precedents, procedural nuances, and courts’ orientations, as they directly impact the strategy and success rate of debt recovery efforts in Mexico.

In summary, these legal reforms enhance the arsenal available to creditors and their attorneys, offering a more direct and effective route to securing and executing upon debtors’ assets. It highlights the dynamic nature of legal practice in the realm of monetary disputes and the critical importance of staying informed on judicial developments to successfully navigate the complexities of debt collection in Mexico.

Performance of state and federal courts

Navigating Mexico’s judiciary reveals wide variations in court operations across its decentralized system, comprising federal and 32 state courts with divergent performance levels. Standardized indexes offer insights into these disparities through metrics assessing efficiency in civil and criminal justice, corruption, infrastructure adequacy, and overall functionality.

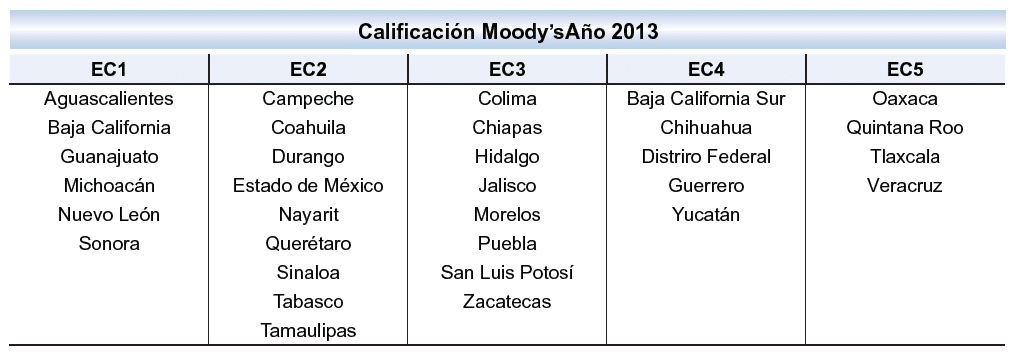

A 2013 report sponsored by the Asociación de Bancos de México (ABM) and conducted by the Instituto Tecnológico Autónomo de México (ITAM), Gaxiola Calvo S.C. (GC), and Moody’s de México S.A. de C.V. (Moody’s), evaluated the impact of judicial institutions on contract enforcement across Mexico. The report measured the quality of these legal institutions, speed of procedures, and adequacy of resources affecting the ability to collect on breached agreements, ranking judiciaries across states according to their performance levels. The following excerpt from the report showcases their ranking results as graded by Moodys:

Although a bit outdated, the report highlights the well-performing courts of Aguascalientes, Guanajuato, Nuevo León, Baja California, and Sonora which remain among the most efficient and competitive states according to other indexes referenced below. Based on experience, I can personally attest to the quality and efficiency of these courts, especially Aguascalientes and Guanajuato, which function impressively well.

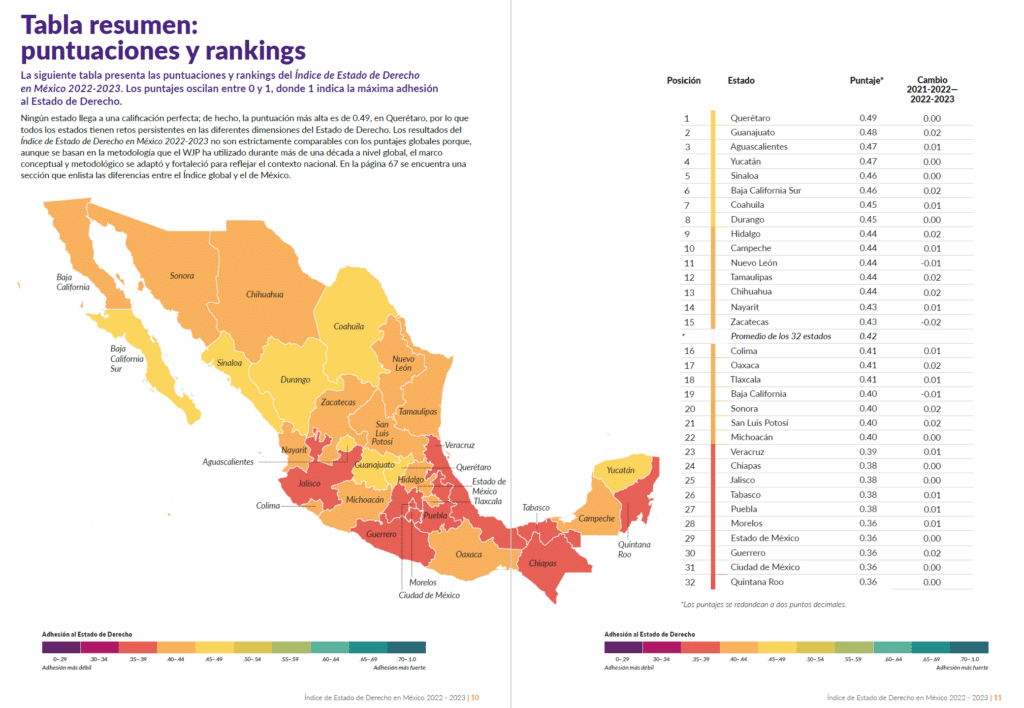

Similarly, the 2022-2023 Mexico Rule of Law Index offers insights into legal institutions and contract enforcement across different states. Developed by the World Justice Project, the comprehensive index measures adherence to rule of law principles based on surveys of over 12,800 people and 2,000 legal experts. By benchmarking states across factors including civil and criminal justice effectiveness, it offers understanding of regional legal disparities while diagnosing strengths and weaknesses relevant for creditors enforcing contracts in Mexico.

The rule of law report highlights well-ranked states like Guanajuato, Nuevo León, Querétaro, and Aguascalientes for civil justice metrics such as impartiality, lack of corruption, quality, and efficiency in the legal process. These states also rank as competitive in the 2023 Mexico Index for State Competitiveness from Instituto Mexicano para la Competitividad A.C., confirming their favorable legal and business environments. From experience, I can personally confirm the high quality and efficiency of courts in these states, making them prudent litigation venues.

The following excerpt from the Mexico Rule of Law Index showcases state rankings:

As shown, these reports offer guidance on Mexico’s civil justice systems essential for enforcing contracts. We can confirm certain jurisdictions like Aguascalientes and Queretaro as high-functioning, while states like Guerrero, Veracruz, and Yucatán present poorer outcomes signaling creditor risks. However, standardized indexes cannot quantify opaque informal factors disproportionately influencing local proceedings. Therefore, prudent creditors should engage experienced Mexican legal counsel possessing crucial insights into regional issues affecting business disputes.

These qualified attorneys can elucidate granular details that standardized indexes cannot capture, from ambient violence around local courthouses to the orientations of individual judges and potential unconscious biases that can potentially and regrettably impact foreign creditors. It’s important to understand corruption does not tarnish all jurisdictions. While some states grapple with corruption plague, others remain relatively untouched. Similarly, certain venues feature expeditious proceedings with qualified judges, while elsewhere lawsuits languish years due to shortages of staff, infrastructure or even willingness to accept certain “undesirable” case types. For example, though generally more efficient, some federal courts reject commercial and civil cases to focus on criminal and amparo cases, forcing such private disputes into backlogged state venues. However, counterexamples defy assumptions, as some state courts operate with higher quality and speed than their federal peers.

By pooling quantified index data evaluating conditions of judiciaries with attorneys’ qualitative guidance examining key informal influences, creditors can fully evaluate specific venues and select optimal locations positioning claims for timely and decisive enforcement.

If unavoidable dysfunction looms large over a required jurisdiction, creditors must temper expectations and maximize early asset seizures by pursuing available prejudgment attachments and garnishment orders, rather than purely relying upon problematic state judges and infrastructure after initiating litigation. Ultimately, leveraging knowledge of jurisdictional variability grants an advantage to observing creditors who cautiously file legal actions where local conditions best facilitate fair and decisive rulings over reflexively defaulting to regular venues. Progress remains uneven, but strategic venue selection secures the greatest probability of success amid Mexico’s federated legal complexity.

Conclusions and final recommendations to creditors

Navigating Mexico’s complex legal system to successfully recover owed funds requires that creditors first realistically assess prevailing realities and legal obstacles before crafting an optimized strategy. Commercial (B2B) debtors often boast sophistication. Decision makers include educated and savvy business owners or highly qualified professionals as controllers, accounts payable managers, CFOs, etc. These debtors exploit the system’s flaws, and reliance on courts alone proves an uncertain path without proper structuring from the outset, given structural inefficiencies. But knowledge empowers creditors to defeat obstacles through preparation and diligence, and by methodically mapping solutions to unique situations. Creditors showing strategic preparation and jurisdictional wisdom can surmount roadblocks with thorough planning and diligent progression. By acknowledging pitfalls while charting paths that consider unique contexts, creditors can attain the required mastery to ultimately prevail despite the hurdles.

The following are our final recommendations for creditors to attain such mastery and prevail.

Conduct early planning and risk analysis

- Scrutinize counterparties before extending credit or shipping goods by obtaining financial records, researching directors, and confirming identities and government registration status.

- Structure transactions to allow access to privileged actions from the outset in case of dispute, whether by requesting debt instruments (promissory notes) or collateral and guarantees, which grant access to specialized proceedings.

- Weigh risks and opportunities across jurisdictions to inform venue selection strategy, should disputes arise. Partnerships with experienced attorneys in Mexico are key here.

Prioritize out-of-court settlement attempts

- Make initial contact respectfully referencing financial records and relevant laws supporting debts, while avoiding litigation threats and instead proposing reconciliation. The goal is signaling readiness to settle amicably, not sue.

- Explore settlement options involving payment plans or alternate collateral, documenting agreements properly while reinforcing with security devices and debt instruments. Even nominal initial payments preserve rights and reinforce the creditor’s case.

Commit to meticulous legal formalities

- Ensure properly executed underlying contracts and all supporting documents satisfy legal requirements in Mexico before disputes emerge. Any deviance compromises cases.

- Carefully transfer overseas corporate authorizations to appoint Mexican legal counsel through formal powers of attorney or temporary rights assignments. Prior services agreement should support such temporary transfer or legal representation to preserve creditor’s rights.

Methodically evaluate the legal landscape

- Review the latest trusted rankings like The Rule of Law Index in Mexico 2022-2023 and the Mexico Index for State Competitiveness 2023, assessing institutional stability across states to inform venue selection.

- Discuss with experienced attorneys in Mexico to understand court functionality, court’s orientation or predisposition based on regional case law, implementation of online systems and technology to facilitate case filings and hearings, and general performance and corruption levels at both state and federal levels.

- Verify the proposed legal approach aligns to case specifics, whether pursuing ordinary, executory, oral, or specialized proceedings based on unique needs and supporting documents available.

Strategically plot legal progression

- Seek early prejudgment attachments either through specialized proceedings or through separate preliminary actions to secure relief pending case progression. If warranted, explore additional measures granted as interim relief, including restraining orders and injunctions.

- Seek preliminary actions to reinforce a claim through an acknowledgment of debt or by securing missing or required evidence.

- If mounting case delays threaten to postpone recovery timeframes, reassess settlement options with payment plans that are efficiently and effectively enforceable through the courts, even if requiring conceding payment terms or surrendering collateral control, to drive mutual agreement.

The path to successfully recovering owed funds in Mexico can undoubtedly prove challenging. But diligent and astute creditors willing to acknowledge prevailing systems, structure agreements considering eventual disputes, and work towards settlements while competently assessing and leveraging legal procedures can still emerge victorious despite the hurdles. With the right strategic planning and execution, success remains achievable.

If confronting a complex cross-border Mexican recovery scenario without clear solutions, please reach out to our international team at HMH Legal to schedule a free initial consultation to assess your situation in confidence. For over 25 years, our attorneys have guided numerous foreign creditors to favorable outcomes through case-specific counsel, leveraging extensive litigation expertise and in-depth jurisdictional knowledge.

DISCLAIMER: The information you obtain in this article is not, nor is it intended to be legal advice. The law office of HMH Legal will only provide legal advice after having entered into an attorney-client relationship. It is imperative that any action you undertake be taken on the advice of legal counsel, and not based solely upon this article.

This material has been provided as free educational message by HMH Legal. We invite you to send us your comments or to call us for a free consultation. If you have any questions please call us at +1 (619) 819-5107 or +1 (619) 819-8518. You can also email us at info@hmhlegal.com. If you would like further information about our firm or our educational handouts, please visit us at www.hmhlegal.com. © 2024 Romelio Hernández. All Rights Reserved.