Summary: Are UCC filings effective with debtors or collateral outside the USA, in Mexico for instance? Is it a reliable tool for creditors in these situations? Sadly, such UCC fillings are likely worthless. Nonetheless, the RUG and pledge are comparable options in Mexico that work and can help creditors in similar ways.

Introduction. UCC filings, security interests, and its effects in Mexico

If you stumble upon this article, it means you are familiar with UCC filings, and its related concepts of security interest and security agreement. A security agreement is a legal document or contract that grants a lender or creditor a “security interest” in specific assets of his borrower or debtor. The security interest allows the lender to repossess and sell such “pledged” assets (“collateral”) if the borrower defaults on his loan, getting paid from the proceeds out of the sale.

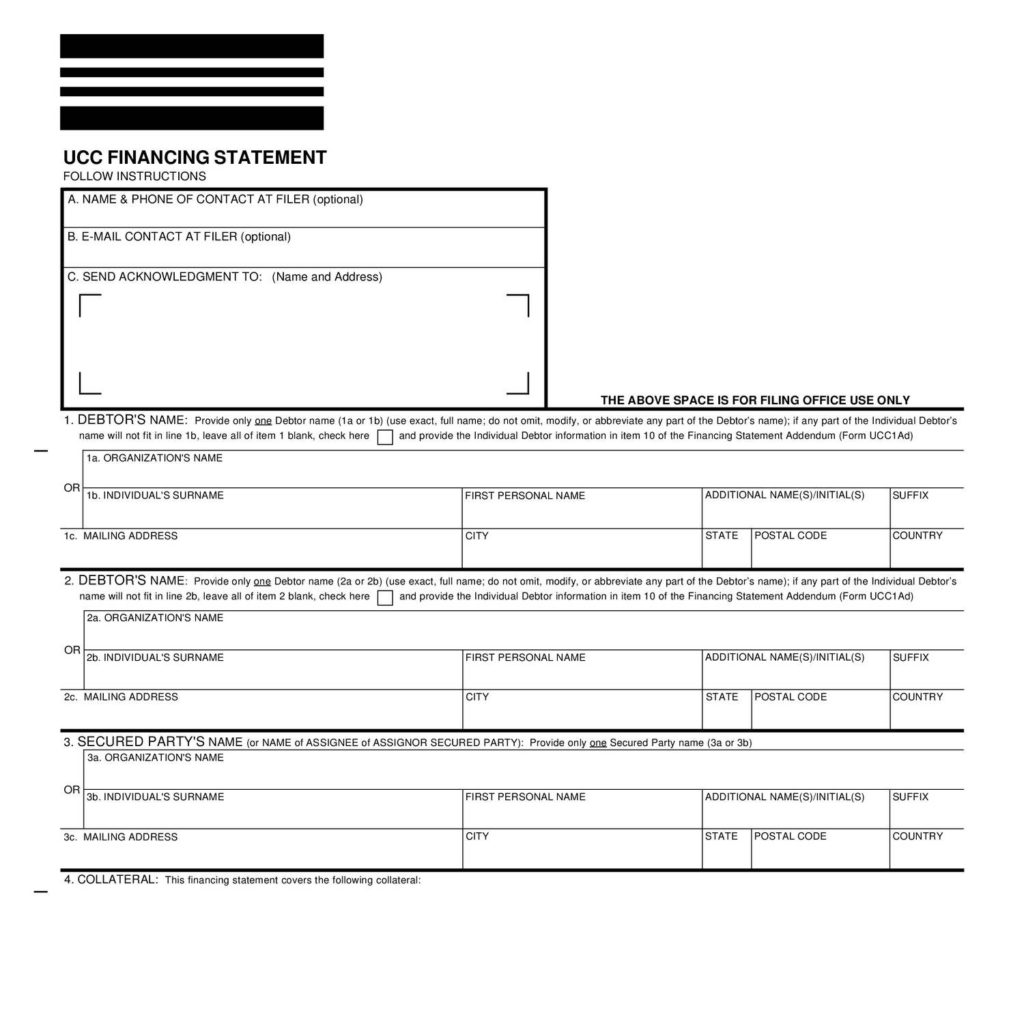

One of the best things about the security interest is that it grants this “preferential” right to the creditor with exclusion of other creditors out there, including a trustee in the case of bankruptcy of his debtor, as long as third parties are put on notice of the security interest. This is where UCC filings come in. By filing a “financing statement” (known as a “UCC-1 filing” or “UCC-1 form”) at the secretary of state’s office of the location of the debtor, all other creditors are automatically put on notice that you (creditor) have a preferential right to claim specific assets of the debtor. The filing confirms that the security interest has been “perfected” and is legally enforceable against anyone. In a sense, creditors out there have been “warned”. The rationale is that creditors looking to lend money or offer trade credit to a company (a debtor), should search for any UCC filings at the debtor’s secretary of state (in the State where the debtor was incorporated or where he is conducting business), to find out about any currently filed liens or security interests in favor of other creditors, which would signify greater exposure or risk. Creditors who avoid the search do so at their own peril.

But what happens with international loans or trade credit, when the debtor is a Mexican corporation, located and doing business in Mexico or any other country outside the USA? Will a UCC filing be valid and enforceable abroad? Will that UCC filing provide security to the creditor? The short answer is that when debtors are outside the USA, all bets are off, and your UCC filling will likely be worthless.

Since the UCC filing is made in the USA, it means that creditors in Mexico, where the debtor is located, are not properly put on notice of a preferential right that you hold, as a secured creditor. For a security interest or lien to be effective in Mexico, it must be filed at a similar or equivalent “public registry” as the secretary of state’s office. But is there something similar or equivalent? Enter the “RUG” filing system in Mexico.

The RUG filing system in Mexico

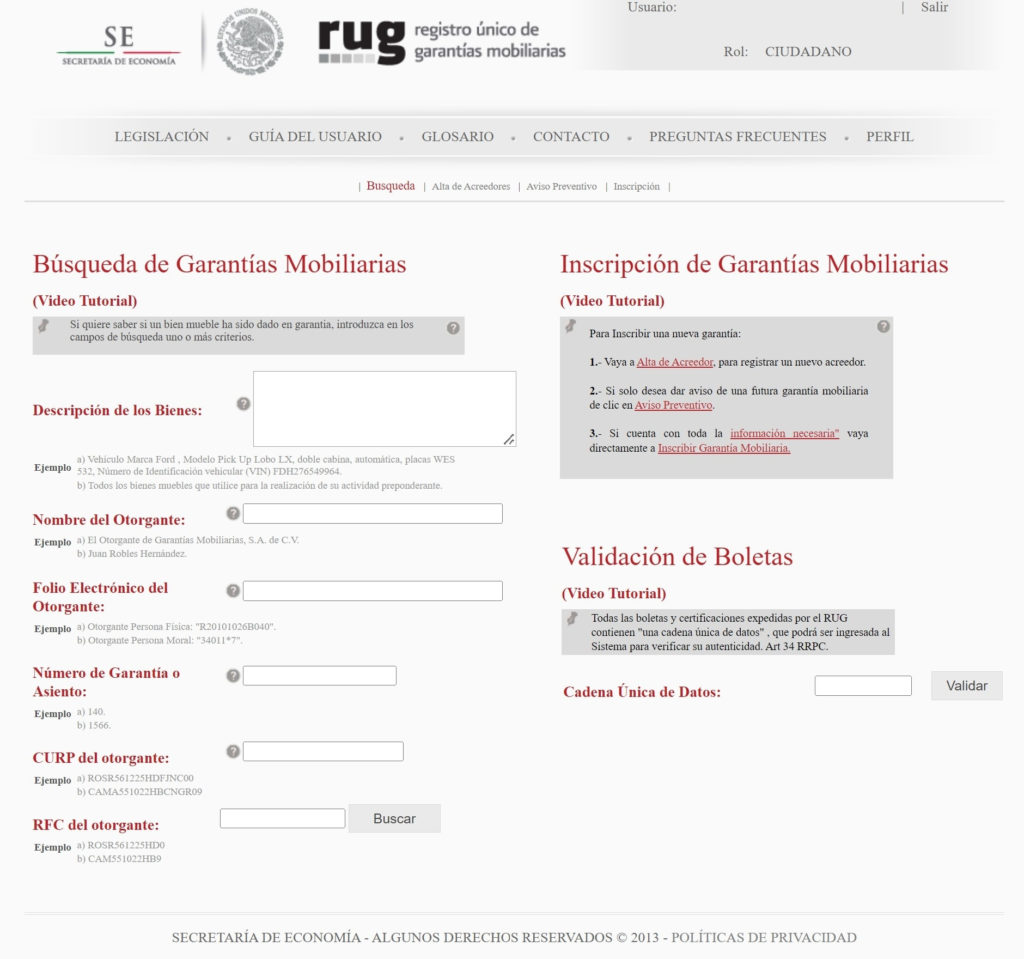

The “RUG”, an acronym for “Registro Único de Garantías” (more or less the “single registry for guarantees”), is an online platform developed by the Mexican government in 2009-2010 to allow efficient and effective filing of security interests throughout Mexico. The initial intent was to facilitate the development of our own system of security interests created through the new non-possessory pledge, which was enacted in 2000 (substantially amended in 2003), to create a security device that would resemble the security interest from Article 9 of the UCC (Uniform Commercial Code) in the USA. From there it followed a robust tool which allowed the filing of all other transactions identified as “commercial” in nature, including loans, liens, and everything in between as it pertains to rights in personal property or movable assets, as opposed to real estate.

The RUG system has grown rapidly to become a success story in Mexico. According to numbers from Mexico’s Secretary of Economy, the number of filings during 2010 and 2011 combined to 13,719. By July of 2013, that number rose to 150,707 filings. The most recent report says that a total of 2,096,109 filings were made in 2020 alone. Back in 2013, attorney Harry C. Sigman, a law professor from Harvard University wrote that “the RUG is one of the best movables security registries functioning in the world.” From this, several questions stand out: Is the RUG system that good? What is so great about the RUG system? How does it help creditors? Is this a tool that will help with the UCC filing in Mexico?

Features, benefits, and convenience of the RUG

To summarize, the RUG is an effective system for secured transactions, helping creditors in many ways. It is an efficient and reliable system, and it simply works. Creditors looking to “perfect” a security interest can turn to the RUG and have it done within minutes, at the click of a button, for free. The following are some of the main highlights of the RUG:

- Free. There is no cost to consult the RUG or do a filing. While you may hire and pay Public Notaries or lawyers to assist with these filings, the RUG itself will charge nothing.

- Online. The RUG is an online platform or website, and parties can access it 24/7 to get information or to make their own filings. Everything is done electronically, and no paperwork needs to be submitted to the authorities, if conditions are met. You can even download genuine filing certifications.

- Notice-filing as opposed to transaction-filing. Local public registries in Mexico operate under a model of transaction-based filing, which means that you needed to submit the main contract or agreement that supports your transaction for review. After registry officials confirm validity of the transaction and filing, the filing is authorized. This can take weeks or even months, making for great horror stories. Not anymore. The RUG operates under a simple notice-filing model, which means that you are not required to submit the underlying agreement, but simply an extract of the information required for the filing at the RUG in Mexico (a comparable financing statement or UCC-1 filing, let’s say), and that’s it.

- Public. The RUG is a public database, which means that anyone can access it, in Mexico or abroad. This comes with a caveat, as only individuals with a Mexican tax ID will be able to create an online account that allows access.

Constraints, drawbacks, and limitations of the RUG

While the RUG is a thing of beauty and works as the comparable option for a UCC filing of a financing statement in Mexico, it does have limitations.

- Online filing available only to registered taxpayers in Mexico. Foreign companies or individuals who are not registered taxpayers in Mexico cannot take full advantage of RUG, through immediate online filing. These foreign creditors will still be able to file at the RUG, but they will have to retain an attorney or a public notary to assist with the process, which will add some cost, and paperwork. Another option will be to visit one of the local RUG offices throughout Mexico and submit directly over the counter. This, however, proves the most difficult, without the assistance of legal counsel in Mexico.

- Power of attorney may be required. The case of foreign creditors referred to above adds other difficulties for corporations. The individual who will request the RUG filing will have to prove his authority to act on behalf of the company. This will require some type of power of attorney that is satisfactory to the notary public or the RUG office officials. This is usually harder than it seems.

- Restricted to commercial transactions. RUG filings are restricted and allowed only for transactions or contracts that are specifically set forth in Mexico’s Commercial Code, which are deemed “commercial” in nature and recognized under Mexican law. This means that the filing of security agreements or other contracts governed under the laws of the USA, or any other country is doubtful. Simply, those contracts or legal institutions are not recognized under Mexican law, and not specified under the categories that are authorized for filing at the RUG.

- Filings are valid for one year, by default. Not necessarily a limitation, but a risk if not mindful of this limited term of validity. If nothing is provided or indicated at the time of filing, the RUG filing will only be valid for one year. This can be renewed every year, before the filing expires. Even better, a creditor can request a longer expiration term, provided that the debtor agrees to it in the underlying agreement or transaction.

What happens with security agreements governed under the laws of the USA or other countries?

The first problem with these agreements is that it is doubtful whether the RUG will allow filing of such foreign —and alien— legal agreements. Simply, they are not expressly recognized under Mexican law as within the spectrum or categories of contracts or transactions allowed for filing at the RUG.

Secondly, complications arise from a practical standpoint. It may be completely impractical to enforce a foreign agreement through the Mexican courts, or to enforce a foreign judgment against the debtor. When a creditor is pursuing collateral, you want to move in fast, in a fairly predictable way, and with the least of challenges or risks. Trying to enforce an agreement made under the American law is not efficient or predictable, which is also the case for trying to enforce a foreign judgment.

Thus, if a foreign security agreement (and UCC filing) is not the best option to secure transactions with debtors or collateral in Mexico, then what is the creditor’s alternative? Enter the “non-possessory pledge” in Mexico.

The non-possessory pledge as an alternative to the security agreement in Mexico

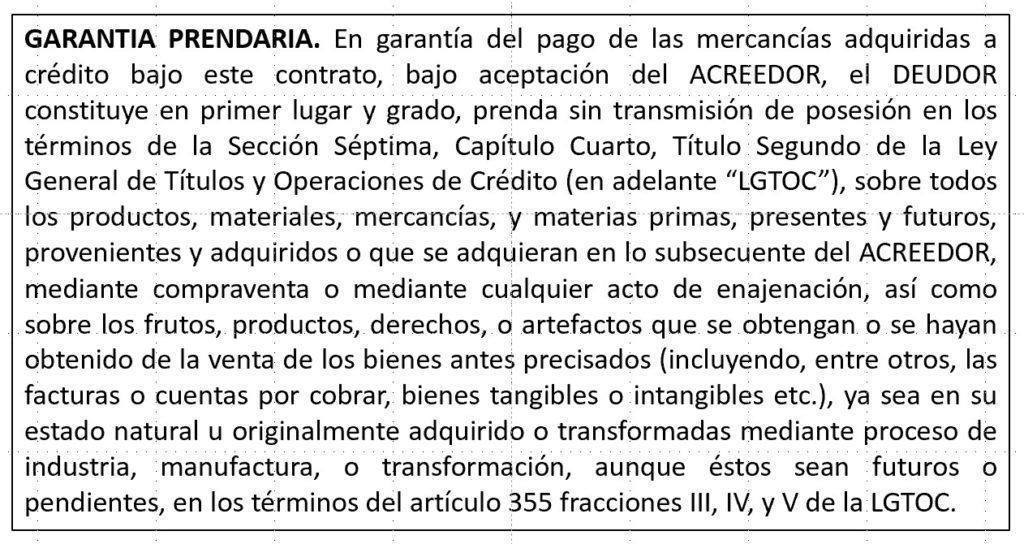

As stated above, the non-possessory pledge (“pledge”), was created in 2000 in Mexico as a security agreement that would resemble the security interest from Article 9 of the UCC. The pledge is a contract by which a creditor acquires a security interest in movable assets of the debtor (tangible or intangible) to guarantee payment of a debt, with the debtor keeping possession of the property. It resembles the American security interest and gives many advantages, in the following ways (traits that the previous security device in Mexico did not share):

- The debtor can keep possession of the collateral.

- Collateral can be described generically, which enables security interests to apply over categories of goods such as inventory, equipment, accounts receivables, etc.

- The security interest extends over proceeds resulting from the sale of collateral. Thus, when the debtor sells pledged inventory, the security interest automatically attaches over receivables resulting from the sale.

- Creditors can lend based on future acquired goods, which will serve as collateral.

- The pledge can secure future advances or obligations, which allows creditors to implement a one-time pledge agreement to secure a revolving line of credit.

- It protects buyers in the ordinary course of business, if authorized, which allows security over inventory.

- It features a purchase money security interest (“PMSI”), which allows creditors to advance loans or sell goods to a debtor whose entire assets have been already encumbered, giving the new creditor preference over any other creditor in respect to those financed or sold goods.

- While repossession is not possible without filing a claim in court (even if breach of peace does not occur), it allows enforcement through a more efficient privileged action, which resembles a writ of replevin.

As such, the pledge is useful in a handful of situations such as in receivables financing or factoring, asset-based lending or equipment financing, and general offering of trade credit where goods or inventory sold is used as collateral, as the security interest will extend to proceeds out of the sale of such goods.

In these and other ways, the pledge is truly a comparable tool to the security agreement and a great option for creditors looking to secure their transactions in Mexico. While we have argued that these security agreements should be heavily reviewed and reinforced by an experienced transactional attorney in Mexico, who will likely suggest additional security devices to reinforce the position of the creditor, the truth is that even a simple one paragraph clause can create an effective security interest in favor of the creditor and help him tremendously. While the example shown here is not my suggestion or advice for your pledge clause, it is something that has proven to work in some situations, with specific transactions. It is a starting point for further review with your lawyer in Mexico.

(For information on other security devices and general protection for trade creditors, please read our article: How to Do Trade Credit in Mexico: 3 Simple Steps to Avoid Bad Debt.)

Process for RUG filing (replacing UCC filings in Mexico)

Unfortunately, foreign creditors missing a Mexican tax ID (because they are not registered taxpayers), will not have direct access to the RUG online platform for direct electronic submissions of RUG filings. Therefore, the best bet for foreign creditors is to hire a lawyer or a notary public who can assist with this task. Another option is to go straight to a local RUG office and request such service over the counter, although this has proven to be the most difficult and time-consuming, especially for foreign companies (corporations) who are not assisted by legal counsel in Mexico. The process, documents, and information required to finish the entire process, is the following:

- Pledge. The first thing you need to have ready for filing is the actual pledge agreement or clause that creates the security interest and that you will use for the RUG filing. Other reliable security devices are also available for specific transactions or creditors (such as title retention, termination or rescission clauses, etc.), so make sure you have the best option for your business or legal relationship.

- Extract for filing. Just like you would fill out a financing statement or UCC-1 form, where all pertinent information for your UCC filing goes in, it is recommended to have an extract of the information that is necessary for the filing in Mexico through the RUG. Here you want to be cautious and not include confidential information that should not be shared publicly through the RUG, but only that information which is required to put third parties on notice of your security interest in the debtor’s assets. This required information is the one related to the creditor, the debtor, the collateral, the specific clauses that need to be publicly disclosed, as well as restrictions on use of collateral. This is where good legal counsel pays off, as they will make prudent recommendations to keep strategic information out while still doing an effective filing for an enforceable security device.

- Power of attorney. Foreign companies (corporations) looking to file at the RUG, will likely be required to prove that the individual requesting the filing on behalf of his principal (the corporation) has actual authority to do that. Since liability carries over to the creditor for any wrongful or illegal filing (such as when a debtor didn’t sign a security agreement or didn’t authorize the filing), RUG officials and notaries will request proper evidence of the individual’s authority, in the form of a power of attorney. Again, it will be the job of legal counsel in Mexico to assist with and facilitate this part.

While these three items may seem daunting and time-consuming, the best strategy is to create a sound system for securing transactions with the help of a lawyer in Mexico, who will advise on the best security device, the proper extract for filing, and prepare a valid power of attorney for all filings. An experienced transactional lawyer will also have strong relationships with reliable notaries who will assist in facilitating and expediting the process. This will help you establish a policy for regular business in Mexico and it will pay dividends down the road through efficient and cost-effective RUG filings, as you would expect from usual UCC filings in the USA.

DISCLAIMER: The information you obtain in this article is not, nor is it intended to be legal advice. The law office of HMH Legal will only provide legal advice after having entered into an attorney-client relationship. It is imperative that any action you undertake be taken on the advice of legal counsel, and not based solely upon this article.

This material has been provided as free educational message by HMH Legal. We invite you to send us your comments or to call us for a free consultation. If you have any questions please call us at +1 (619) 819-5107 or +1 (619) 819-8518. You can also email us at info@hmhlegal.com. If you would like further information about our firm or our educational handouts, please visit us at www.hmhlegal.com. © 2022 Romelio Hernández. All Rights Reserved.