Summary: Creditors who extend credit and loans require reliable and cost-effective security devices to protect them against non-payment. The pagaré in Mexico is a convenient tool. Therefore, this article explains: 1) the rules that affect international promissory notes to be enforced in Mexico; 2) the laws that govern pagarés in Mexico; 3) the basic drafting of pagarés in Mexico; and 4) issues to consider before executing pagarés to be enforced in Mexico.

Introduction to pagarés, promissory notes, and secured credit in Mexico

There is great concern for companies and individuals every time they are about to extend credit. These can be direct loans or sale of goods on open account terms, also known as trade credit. Creditors want to secure their debt effectively. They need fast and reliable relief should their debtors fail to meet their obligations voluntarily.

One way of effectively securing loans is through promissory notes or pagarés, as they are known in Mexico and most Latin American countries. In Mexico, such tool or security device will allow for an executory proceeding in the courts. This results in a faster and more reliable case when seeking legal collection.

Because a successful enforcement of a pagaré will highly depend on the content of the note and the way it is executed, it is essential to know the rules that come into play and regulate the pagaré in Mexico. Therefore, this article will briefly explain: 1) the Mexican conflict of law rules that affect international promissory notes to be enforced in Mexico; 2) the basic laws and rules that govern pagarés in Mexico; 3) the basic drafting of commonly used pagarés in Mexico; and 4) important issues to consider before executing promissory notes to be enforced in Mexico. First, however, we should briefly understand what does a pagaré means.

What is a Pagaré?

A pagaré is a “note” (a document) that contains an unconditional promise to pay a fixed sum of money to a specified person, or to the bearer of the note. This can be at a specified date or upon demand. It is a “promissory note” that is recognized and enforceable under Mexican law.

The pagaré is not theoretically a security device. However, it does add some level of security to creditors looking to provide loans or extend trade credit. The note grants the creditor access to an executory type of proceeding for enforcement, which has many advantages. First, the creditor can immediately seize assets from his debtor without the need of placing any bond. Second, there will be a legal presumption of his debt, which will turn most burdens of proof on his debtor.

Rules that affect international promissory notes to be enforced in Mexico

A promissory note is affected by the laws and rules of those countries in which the note has contacts with, based on several issues: the place where the note is issued, the place where the obligation is to be performed (where payment will be made), the domicile of the debtor, the governing law provided for in the promissory note, etc.

That means that if a promissory note is issued in the USA and it is to be paid or enforced in Mexico or in another foreign country, chances are that some laws from the USA will come into play when seeking enforcement outside American jurisdiction.

Consequently, we need to address the importance of such rules to better assess and decide whether it is recommended or not to draft and execute such promissory notes outside of Mexico (subject to the laws of the USA), if an enforcement action will eventually be sought in Mexican territory.

Although general rules on conflict of laws are included under articles 12, 13, 14 and 15 of the Mexican Federal Civil Code, specific rules conflict of laws are provided for promissory notes under the General Law of Commercial Paper and Credit Transactions (LCPCT), specifically, articles 252 through 258.

Article 253 provides that the general conditions for the validity of a promissory note issued overseas will be determined by the law of the place where the note is subscribed. However, if the note will be paid in Mexico, such note will only be deemed valid and enforceable if it contains the basic requirements provided for under Mexican law (i.e., the LCPCT).

Although this may sound reassuring for parties issuing or obtaining promissory notes overseas to be enforced in Mexico, there is a downside for choosing this option.

Article 252 of LCPCT provides that the legal capacity to issue a promissory note overseas (outside of Mexico) will be determined according to the law of the State where the note is issued (signed). Also, article 254 provides that if no governing law is selected and confirmed for such note, the rights and obligations that derived from it will be those governed by the law of the State where note is issued.

This means that foreign laws pertaining to legal capacity of individuals or corporations, and rights and obligations that arise from the promissory notes will have to be pointed out and proved in a Mexican court, when seeking direct enforcement in Mexico. This makes for a troublesome, riskier, and costlier case, something you can avoid by accommodating your promissory notes to be subscribed in Mexico, based exclusively on Mexican law. This is recommended when you are anticipating a future enforcement in Mexico.

Requirements of pagarés according to Mexican law

If you are anticipating that a collection attempt through legal action will be best pursued in Mexico, it will be important to consider the basic requirements for pagarés as provided under Mexican Law. Some of these requirements will be assessed by Mexican courts to decide if the note is valid and enforceable. Other requirements will allow the court to rule on other issues such as proper venue and jurisdiction, governing law, limitation period (“praescriptio”), etc. It should be noted that “credit instruments” (such as pagarés, promissory notes, checks, etc.) are a matter of federal law in Mexico, and they are regulated by the LCPCT, regardless of the particular State or jurisdiction where the document is issued.

According to article 170 of the LCPCT, a pagaré that is compliant with Mexican Law must contain the following:

- Pagaré. The express statement that the document is a pagaré, contained within the note itself. This is one essential requirement for the pagaré to be valid and enforceable. Take note that courts will look for the wording “pagaré”, and not promissory note.

- Unconditional Promise. The unconditional promise to pay a certain amount of money. This statement is also essential for validity of the pagaré. This includes 1) the unconditional promise: “I unconditionally promise to pay…”, or in Spanish: “pagaré incondicionalmente…”; and 2) the amount that the pagaré is worth. This amount can be stated in foreign or national currency, but it must be specific and determined. You must clearly point out a fixed principal amount in the pagaré and, in addition, you can also include an interest rate.

- Beneficiary. The name of the company or individual to whom the payment is to be made. It is essential to include the name of the beneficiary within the note. The beneficiary can be either an individual or a corporation (national or foreign). A note made payable to a “bearer” is not acceptable and will not be enforceable.

- Payment. The time and place where the payment is to be made. This is not essential for the validity of the note. Still, such clause will determine the proper venue and jurisdiction to bring suit. This may be useful when the creditor has corporate offices and a legal department in one part of Mexico, and wishes to bring every suit there, regardless of the domicile of their Mexican debtors. If no specific place is pointed out, the place where the pagaré was issued will be considered. If the date of payment is missing (date of maturity), it will be considered payable upon demand.

- Issuance. The time and place where the note is subscribed. A pagaré will be deemed null and void if the time or place of issuance is missing. The place of issuance is essential for the court to determine the governing law applicable to the pagaré. The time of issuance will help decide if the note is being enforced within the limitation period (“praescriptio”).

- Signature. The original signature of the issuer of the note. The signature is the most essential requirement for validity of the pagaré. A faxed or copied pagaré will not have full legal effect in Mexico for enforcement through an executory proceeding. The pagaré should bear an original or authentic signature to be enforceable.

Basic drafting of pagarés in Mexico

If you want to keep it simple and make sure that you are drafting a pagaré that complies with Mexican law, you should look no further than the requirements mentioned previously. You can also add other clauses or features to customize the note according to your needs, including a fixed rate, late payment fees, collection fees, payment plan or scheduled of payments, etc. These, however, should be carefully drafted and, therefore, will not be addressed in this article.

Other information that is also important and should be carefully drafted is the debtor’s full name at the bottom of the note, right below his signature. You must point out if the debtor is a company or an individual and, if the debtor is a corporation, you should include the full name of the individual who is signing on behalf of said company. Finally, the address of the debtor should also be included.

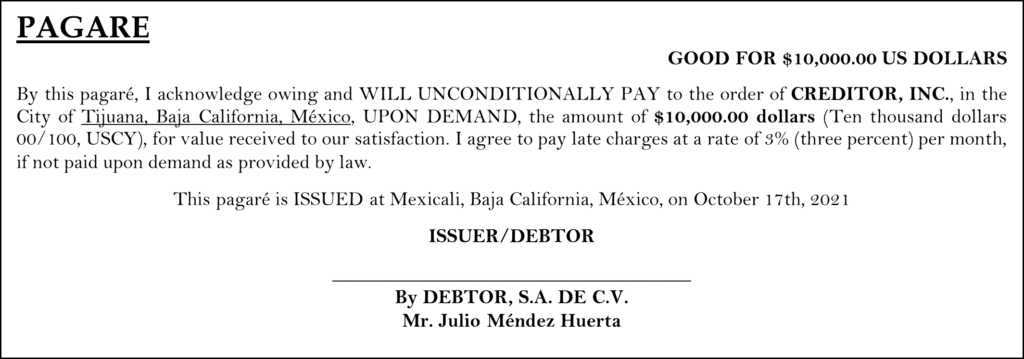

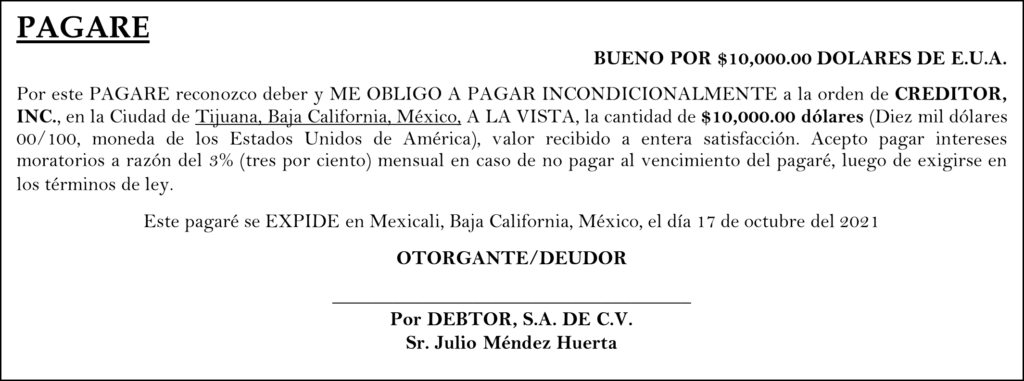

The following is an example of a pagaré format that meets all the conditions indicated in the previous section, as well as the information pointed out in the previous paragraph. The pagaré also contains a clause that provides for a late payment fee:

Although the example pagaré is presented in English and Spanish languages, drafting pagarés only in in English language will force a creditor to prove in a court of law its content in Spanish language through proper a translation by an expert translator, upon enforcement. This is something you can avoid by drafting your pagarés in Spanish or by accommodating an English/Spanish version in the same document.

Final considerations before executing a pagaré in Mexico

We now offer some recommendations to keep in mind upon executing (issuing) pagarés and before starting any lawsuit for enforcement. These may help in limiting the debtor’s arguments and defenses through the executory proceeding.

- Individual authority. When the issuer/debtor is a corporation, make sure that the individual signing the note has full authority to sign or issue credit instruments (títulos de crédito) on behalf of said corporation. You can confirm this by requesting an authentic copy of his power of attorney (POA), which should be contained in a notarial deed. The POA should contain a specific clause that indicates this specific authority to sign or issue “títulos de credito”. (The free report from HMH Legal will usually provide information on the legal representatives of a company.)

- Corporate authority. When the issuer/debtor is a corporation, make sure that the act of issuing pagarés or credit instruments is provided for under its corporate purpose. You can confirm this by examining the company’s corporate deed or articles of incorporation and bylaws (acta constitutiva). If such corporate deed does not specifically provide the authority to issue “títulos de crédito” within the corporate purpose section (objeto social), the note will be deemed null and void.

- Genuine signature. Make sure that the signature is genuine and from the individual who is actually supposed to be signing the note. A copy of his identification with his signature, or previous checks issued by him can help examine this.

- Limitation period. When seeking enforcement of a pagaré, make sure that you file suit within three years of the date of maturity. The limitation period for the enforcement of pagarés is three years in Mexico, regardless of where the note was signed.

- Guarantor. A guarantor or “aval” is a great way to reinforce your guarantee of payment by the primary debtor. This is especially helpful when your debtor is a corporation, and you don’t want to run the risk of encountering an undercapitalized company down the road, upon enforcement. The individual signing the note can personally commit towards the company’s debt (jointly and severally) just by including a statement that says “por aval,” and signing below along with his full name printed (excluding the company’s name).

A final suggestion is to keep your pagaré short and simple for everyday credit sales. If pagarés are used to secure everyday sales (made on open account credit terms), many companies will be reluctant to sign them if they find it difficult and time-consuming to read and understand. Thus, you should only include essential information on your pagaré, as suggested here. In this case you want your pagaré to be just that, a “note”, not a sacramental contract.

For complex or large transactions, you should find and rely on a reputable law firm in Mexico who can prepare an upgraded or enhanced pagaré and oversee proper execution through a Notary Public or explore other ways of securing credit sale or loan in Mexico effectively.